Warren Buffett’s M&A magic touch comes with batteries included

It's been only nine months since Buffett's deals for Precision Castparts and Duracell closed and it looks like the firms are already earning their keep

Premium

Premium

For most companies, big acquisitions take a while to pay off—sometimes years, if ever. That’s unless, of course, you are talking about Warren Buffet and Berkshire Hathaway Inc.

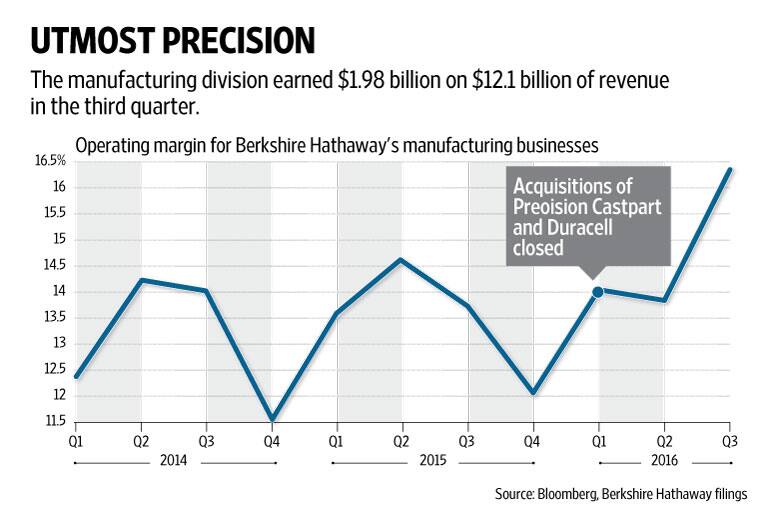

It’s been only nine months since Buffett’s deals for Precision Castparts and Duracell closed, transactions which together totalled around $40 billion. And it looks like the aerospace-parts maker and battery brand are already earning their keep.

Berkshire’s manufacturing division, which also comprises older acquisitions such as Lubrizol specialty chemicals and Shaw Industries carpets, just posted its best return in at least two years.

This helped contribute to a 6.6% increase in the sprawling company’s total operating earnings for the third quarter, but which at $2,951 a share were still a little short of the average analyst estimate, according to data compiled by Bloomberg.

(Berkshire’s profit was partly pinched by BNSF, the North American railroad system that Buffett bought in 2010, as the industry contends with weak freight demand and diminishing pricing power. BNSF’s operating income was down 11% year on year as revenue slid 7.7%.)

What was interesting about the Precision Castparts deal was that the always-price-conscious Buffett, 86, paid a not-so-cheap price.

The transaction valued Precision Castparts at about 13 times its then-trailing-12-month Ebitda (earnings before interest, tax, depreciation and amortization). That’s in line with the median multiple for US mergers and acquisitions (M&A) this year, but that median multiple is also near a historic record.

Earlier last week, I noted that elevated M&A valuations could be a tad concerning. But the difference between Buffett and everyone else is that he doesn’t rely on synergies to justify transactions.

Berkshire also has more cash than it knows what to do with—as opposed to other giant companies, which are putting themselves deeper into debt in a desperate attempt to juice growth.

Yet again, the Oracle shows how it’s done. The question is, what happens when he’s no longer the one holding the elephant gun? BLOOMBERG

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!