Reliance Industries rallies on the back of Jio, GRMs

The RIL stock has risen 9.5% since 2 September to Rs1,109.35 against the 0.8% decline of the S&P BSE Sensex index

Premium

Premium

Reliance Industries Ltd’s (RIL’s) announcement at its annual general meeting of the imminent commercial launch of services by its telecom unit has offered a fresh leash of life to the company’s shares.

The RIL stock has risen 9.5% since 2 September to Rs1,109.35. During this time, the S&P BSE Sensex index has fallen 0.8%.

Reliance Jio Infocomm Ltd’s long-awaited commercial launch has reduced the prolonged period of uncertainty that surrounded this venture. While it was clear that RIL was betting big on the telecom sector, there was no clarity on the launch date or pricing strategy. Both questions have now been answered, and some analysts are excited about the company’s prospects of gaining reasonable market share.

To be sure, Jio’s success can’t be taken for granted, especially as far as returns from the venture go. In a recent interview, RIL’s chairman Mukesh Ambani suggested that Jio was targeting a return of 18-19% on capital.

That won’t be easy to achieve. Analysts from Credit Suisse Securities (India) Pvt. Ltd indicate that achieving that would require revenues that are close to market leader Bharti Airtel Ltd’s; and a similar Arpu (average revenue per user) profile as the top three companies in the sector (around Rs210) at Bharti Airtel’s subscriber base (250 million). “We believe such returns can be difficult to achieve in the first four years," they wrote in a note to clients on 19 September.

But Jio isn’t the only reason for the renewed excitement around RIL shares. Benchmark Singapore complex gross refining margins (GRMs) have surged this month. GRM is a measure of profitability for refining firms. According to an analyst, Singapore GRM, the difference between the per barrel price of crude oil and the value of products distilled from it, touched $7 a barrel on Friday. In the June quarter, average GRM was at $5 a barrel. RIL’s refining business contributed as much as 68% of the company’s stand-alone earnings before interest and tax in the June quarter. Additionally, RIL is also expected to benefit from higher light-heavy and lower Brent-Dubai spreads.

Besides, analysts expect it to generate high free cash flow (FCF) from 2017-18. “RIL is coming out of its capex phase, which in our view will pave the way for a multiyear cycle of strong FCF generation averaging $5 billion per annum over F1Y8-20, implying >11% FCF yield," wrote analysts from Morgan Stanley Research in a report on 25 September. “RIL will benefit from the start of earnings delivery from downstream, which we expect to add ~$3.2 billion in Ebitda by FY18, assuming oil prices remain low at $50 a barrel." Ebitda, or earnings before interest, tax, depreciation and amortization, is an indicator of operating profitability.

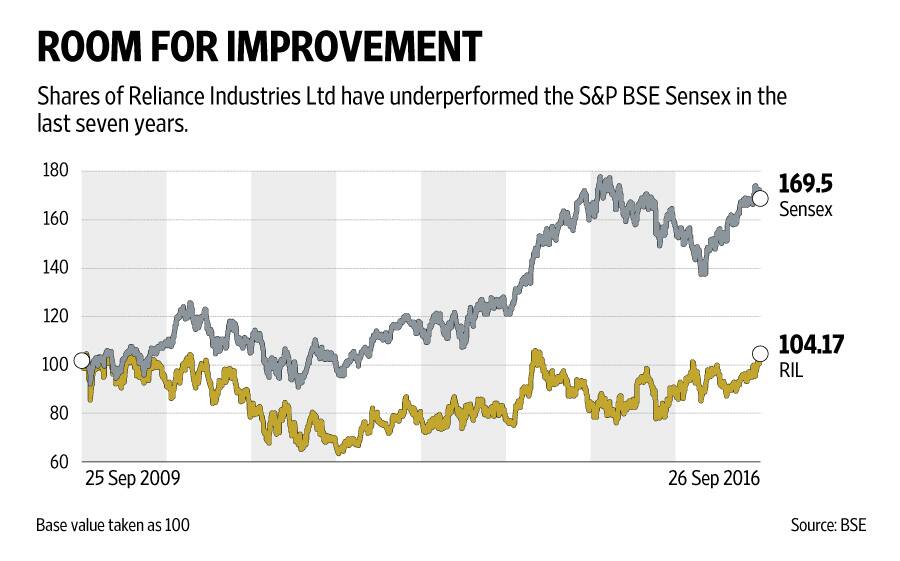

But note that despite the recent outperformance, investors have lost out considerably from a long-term perspective. The RIL stock has underperformed the Sensex in the last seven years by a huge margin. Currently, one share trades at 12.6 times estimated earnings for this fiscal year. From a near-term perspective, the good news seems factored into the price.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!