Why Mindtree’s exaggerated correction makes sense

The company's valuations have also been unusually high for a long time, and so the correction is welcome

Premium

Premium

Mindtree Ltd’s shares have behaved strangely in the past two trading sessions. The company issued a profit warning at the beginning of the week, and it initially seemed that investors more or less shrugged it off, as the shares corrected by only 2.7% on Tuesday. But the next day, after the shares adjusted for a 1:1 bonus issue, Mindtree’s valuation fell by as much as 11.5%.

Some of this is due to the so-called bonus stripping that some high networth individuals engage in, which partly makes it a technical correction. But the company’s valuations have also been unusually high for a long time, and so the correction is welcome.

Mindtree’s statement to investors earlier in the week said that organic revenues will grow only marginally in the March quarter, owing to delays in project starts in the retail and banking, and financial services segments.

Based on the company’s comments at the time of the December quarter results announcement, the expectation was that growth will be better than the 2.3% it reported for the third quarter. Similarly, while the earlier expectation was that margins will grow, Mindtree has now said that margins will decline.

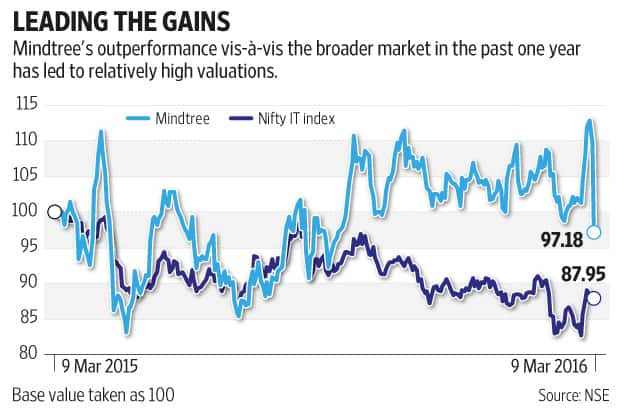

The warning has led to some cuts in earnings estimates—although the 14% fall in the company’s shares looks a bit overdone. Note that this came after a 5% outperformance vis-à-vis the Nifty IT index in the preceding three trading sessions, which, again, was on account of the bonus stripping opportunity.

Bonus stripping involves buying shares just before the ex-date of the bonus issue, and then selling half of the holding at the adjusted ex-bonus share price. In Mindtree’s case, it would have involved, for instance, a purchase at Tuesday’s price of around ₹ 1,550 as the first leg of the transaction. The second leg would involve selling half the number of shares acquired at Tuesday’s average price of around ₹ 700. The resulting loss of ₹ 850 per share can be used to offset short-term capital gains from other transactions. As far as the unsold portion of the portfolio goes, it is typically held for a year to avoid capital gains tax; or in some cases is sold if prices drop beyond a threshold.

Perhaps, a large number of such transactions put pressure on Mindtree’s shares on Wednesday. Even so, as pointed out earlier, the company enjoyed relatively high valuations, and the correction is welcome.

Analysts at Religare Institutional Research said in a note to clients on 8 March, “Mindtree is trading at a premium to the sector and to large-caps. While better growth and execution deserve a premium, we think (a valuation of) 17x serves more of an exit multiple for investors in a sector undergoing ROE (return on equity) compression."

Besides, after the company’s profit warning, expectations on growth would have to be toned down a bit as well.

The writer does not own shares in the above-mentioned companies.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!