Do SIPs really work for you?

In this study, Mint partnered with Hexagon Wealth, a Bengaluru-based boutique wealth management firm, to check how SIPs have performed

Premium

Premium

What do we want from our equity investments? We want reasonable returns; consistently, if not always. And we want returns to beat the inflation, to justify for the added risk that we take. While it’s easy to get to know returns of a particular mutual fund (MF) scheme from its fact sheet or website, those are fund returns. They are advertised. In other words, they are returns that are calculated from one specific point to another. But the returns that you make will not be the same as these. Your entry and exit points could well differ from the period that your fund house advertises.

Besides, most of us invest in equity MFs through systematic investment plans (SIPs). These are monthly or quarterly investments done over a period of time. So, we need to check how SIPs have performed.

What about time periods? Since investors enter and exit at any time, using a rolling return analysis makes more sense to see how SIPs, which started over different points in time, have fared.

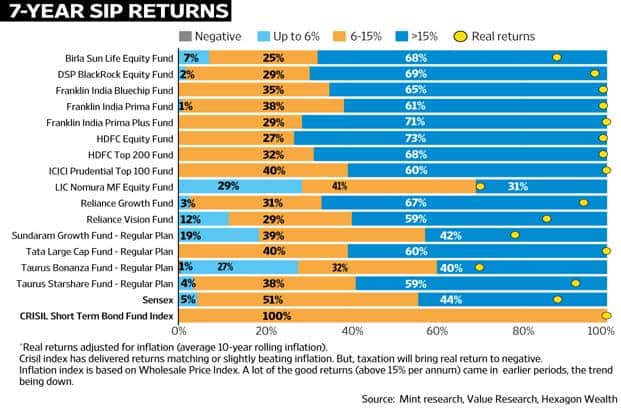

In this study, Mint partnered with Hexagon Wealth, a Bengaluru-based boutique wealth management firm, to check how SIPs have performed. We looked at SIP returns, on a rolling basis (SIPs that start every month for a fixed tenure), for select actively-managed equity funds. To ensure that we get multiple time periods across rising and falling markets, we started off with equity funds that have been around since 1 January 2000.

As per data by Value Research, there were 38 MF schemes in existence in January 2000. We took only diversified equity schemes; and avoided index, sector and thematic funds. Of these, we chose 15. We took a fair representation from most of the fund houses. We took schemes that were popular in those days, at the same time, making sure that there is a mix of large-, mid- and multi-cap funds as well. There was also a performance-based selection; schemes that were top performers then as well as those that weren’t. Some more diversified schemes from the shortlist were dropped because their net asset values on certain days were not available.

How SIPs do over the long term

Each bar in the following graphs represent an MF scheme. The figures inside the bar show the percentage of times the fund has given the returns belonging to any one of the four return buckets. For instance, a 5-year SIP in Birla Sun Life Equity would have given negative returns 1% of the times. It gave returns up to 6% about 13% of the times. Twenty-one per cent of the times, it gave returns of 6-15%. And 65% of the times, it gave returns in excess of 15%. The percentage of times it outperformed inflation is 81.48%. Results for other schemes can be understood in a similar manner. Total period: 1 Jan 2000 till date. Within this all 5-year, 7-year and 10-year periods were taken. SIPs start on the first of the month.

Regular steps

SIP return expectations must be tempered as they also depend on economic growth and market volatility. SIPs are not to be used to maximise returns. They are a tool to channelise your savings or monthly income into equities, on a sustainable basis and systematically, without you having to bother, every month.

Further, despite SIPs taking away the botheration of market timing, returns will vary depending on when you start your SIP and when you end it.

Take a look at 5-year SIPs of some equity funds in this chart. If you had started an SIP anytime during January 2000 to mid-2003 for five years, chances are you would have got returns in excess of 50%, compounded annually. But if you would have started an SIP for any five year periods between 2006 and 2009, your returns would have been muted, comparatively 8-14% on an average, compounded annually. This chart is not about better or worse schemes; it is about whether SIPs work. SIPs are not for maximising returns, but for investing regularly.

Remember: this exercise is not meant to help you choose one fund over the other; the aim is to see if SIPs work or not. Hence, don’t be surprised to find that a scheme that you may have invested in around that time is not on this list.

To pick equity funds of your choice and that are suited to your risk, refer to Mint50 (https://bit.ly/1TGY5e4), Mint’s curated list of 50 schemes.

Finally, 15 schemes were selected, from private and state-owned fund houses. As benchmark indices, we took Sensex and Crisil Short Term Bond Fund index.

Then, we simulated SIPs. Our start period was 1 January 2000. We took three time periods for our SIPs: five years, seven years and 10 years. For each of these tenures, we started a fresh SIP at the beginning of each month, starting 1 January 2000 and ran it for the specified time period (five, seven and 10 years). For instance, the first 10-year SIP would start on 1 January 2000 and go on till 31 December 2009, the second SIP would start on 1 February 2000 and go on till 31 January 2010, and so on.

Next, we clubbed all the returns, within each of the three SIP tenures, into four buckets to get a sense of what the returns have been. These four buckets of returns are negative returns, up to 6% returns, 6-15% returns and greater than 15% returns.

The inflation index used here is based on Wholesale Price Index and not Consumer Price Index (CPI). In the study, the Crisil Short-Term Bond index has also delivered a performance to preserve purchasing power all the time. But on a post-tax basis, it would not be efficient.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!