Nifty hits 10,000. Here’s how it got there

The Nifty 50 index breached the 10,000 mark on Tuesday for the first time ever. Here are five charts that track its ascent

Premium

Premium

Mumbai: On Tuesday, the National Stock Exchange of India’s benchmark Nifty 50 index opened above 10,000 points, the first time it breached that mark. The gauge has since retreated and was trading at 9,969 point as of 10:20am.

Here are five charts that recap the Nifty’s journey to 10,000.

Chart 1: How many days has it taken?

The climb from 9,000 to 1,000, an 11% gain, took 875 days. That’s the most, barring the journey from 1,000 to 2,000 points, which took almost a decade and a similar time from 6,000 to 7,000 points.

Chart 2: The biggest sector gainers

In the current rally, the index climbed beyond 9,000 points on 10 March this year. The overall markets since then have been boosted by the jump in real estate and financial services stocks. Pharma, IT and public sector stocks have been the biggest losers in this period.

Chart 3: The top gaining stocks

Among the Nifty 50 stocks themselves, Indiabulls Housing Finance has led the rally with a near 38% rise. Consumer stock favourites such as Hindustan Unilever Ltd and Maruti Suzuki India Ltd are also among the top five gainers. Lupin was the worst performing Nifty stock during this period.

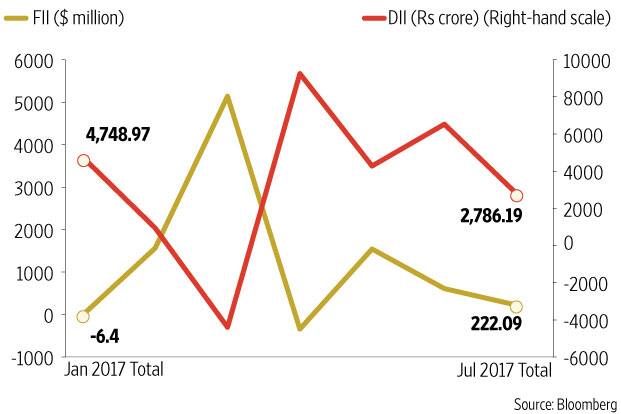

Chart 4: Institutional buying

The rise in Indian equities has been fuelled by consistent buying from domestic and foreign institutions. So far this year, local mutual funds and insurance companies have bought Rs24,000 crore worth of stocks, while foreign funds have purchased around $8.5 billion.

Chart 5: Valuations climb

The rise in stocks has not been matched by an increase in earnings expectations. Thus, valuations measured by the price to 1-year forward earnings yardstick have also climbed making the Nifty one of the most expensive indices in the world.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!