MFs still not the preferred way of corpus building

As income level rises so does mutual fund ownership

Premium

Premium

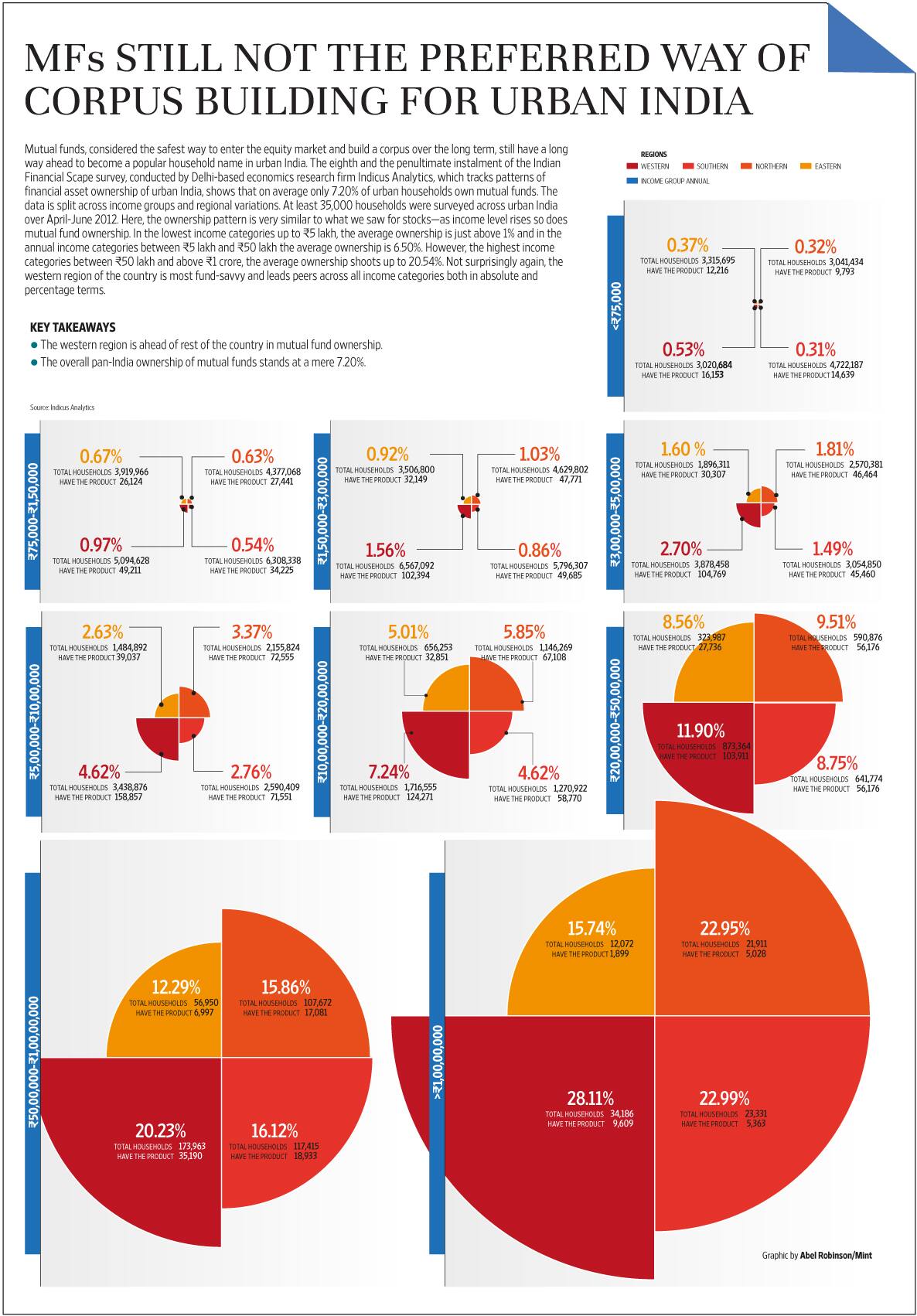

Mutual funds, considered the safest way to enter the equity market and build a corpus over the long term, still have a long way ahead to become a popular household name in urban India. The eighth and the penultimate instalment of the Indian Financial Scape survey, conducted by Delhi-based economics research firm Indicus Analytics, which tracks patterns of financial asset ownership of urban India, shows that on average only 7.20% of urban households own mutual funds. The data is split across income groups and regional variations. At least 35,000 households were surveyed across urban India over April-June 2012. The ownership pattern is very similar to what we saw for stocks—as income level rises so does mutual fund ownership. In the lowest income categories up to ₹ 5 lakh, the average ownership is just above 1% and in the annual income categories between ₹ 5 lakh and ₹ 50 lakh the average ownership is 6.50%. However, the highest income categories between ₹ 50 lakh and above 1 crore, the average ownership shoots up to 20.54%. Not surprisingly again, the western region of the country is most fund-savvy and leads peers across all income categories both in absolute and percentage terms.

Key takeaways:

1. The western region is ahead of rest of the country in mutual fund ownership.

2. The overall pan-India ownership of mutual funds stands at a mere 7.20%.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!