Sebi under U.K. Sinha sharpened focus on developing markets

The Sebi Act, in the past five years alone, saw more than 50 amendments, attesting to the dynamic nature of the regulator's work under U.K. Sinha

Premium

Premium

Mumbai: Under its eighth chairman, India’s stock market regulator was a beehive of activity.

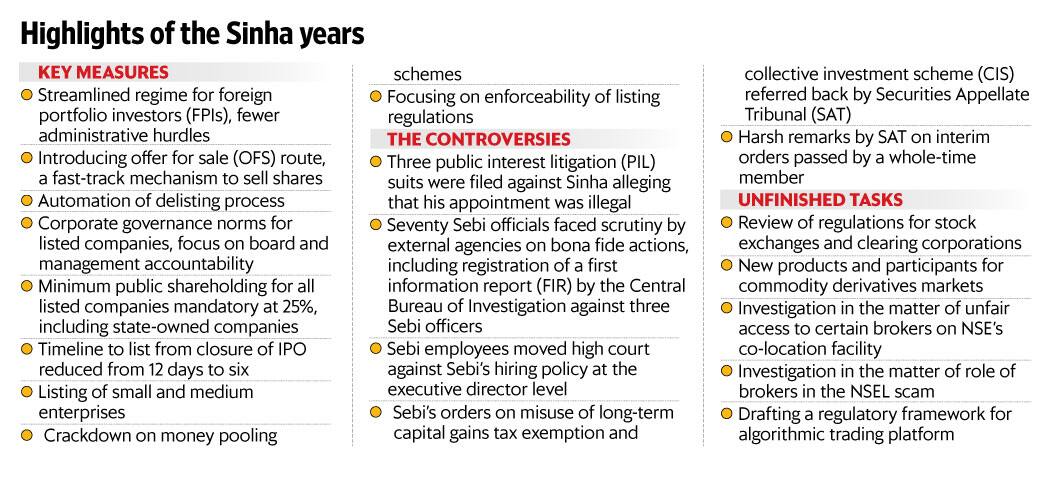

In the six years that U.K. Sinha led it, the Securities and Exchange Board of India (Sebi) expanded its territory as a market developer, on top of its role as a market regulator.

The Sebi Act, in the past five years alone, saw more than 50 amendments, attesting to the dynamic nature of the regulator’s work.

Almost every regulation was reworked and re-examined.

“I would like the incoming chairman to set his own priorities," Sinha said in his last interaction with the media, before new chairman Ajay Tyagi takes charge on 2 March.

India is no stranger to illegal money pooling schemes such as the ones floated by two Sahara firms (Rs25,780 crore), PACL Ltd (Rs49,100 crore) and Saradha group (Rs30,000 crore). In order to check the menace, Sebi was empowered to regulate collective investment schemes (CIS) in 2013.

In 2013, Sebi was also given the power to search and seize, and obtain call data records. After the National Spot Exchange Ltd scam, the government merged the Forward Markets Commission, which regulated the commodity markets till then, with Sebi.

“Sebi is a regulator for all seasons. Whenever the government falls short of a regulator, it turns toward the credibility of Sebi," said J.N. Gupta, a former executive director of Sebi. However, making refunds to investors has not been easy. “Powers is one thing; it is the implementation and the usage of the power vested in a body that counts," said Gupta.

“On investigations and orders, Sebi procedures leave much to be desired. Punishments are often being imposed without the basic process of an investigation and a hearing. The arbitrary power wielded in the executive and quasi-judicial functions at Sebi is inconsistent with our aspiration of becoming a mature liberal democracy," said Ajay Shah, professor at National Institute of Public Finance Policy (NIPFP).

Sebi’s legal expenses rose 30% in 2016 as it defended its orders in the matters of CIS and interim orders on misuse of long term capital gains (LTCG) at the Securities Appellate Tribunal (SAT) and higher courts.

Under Sinha, Sebi cut the time—from an IPO closure to listing—to six days from 12. It is likely to go down to just three days. In 2015, 21 firms raised Rs13,614.08 crore through IPOs, Prime Database data showed. In 2016, 26 companies raised Rs26,493 crore.

“Under the leadership of Sinha, Sebi took steps to clean up the primary market and they have shown tremendous results. He has also revived the mutual fund sector, which has brought back retail investors in the stock market. Sebi has fast-tracked the IPO process and also reduced the time taken for a listing," said Ashish Kumar Chauhan, CEO and managing director, BSE Ltd.

Sebi also opened the Institutional Trading Platform for listing small and medium enterprises (SMEs). “The SME listing process and the initiatives in that regard were also formalized under his guidance. The SME success story in India market reflects the regulatory support to encourage this market," said Chauhan. According to Sinha, more than 200 firms have listed on the SME platform, who calls it “a proud moment for us." However, Sebi’s bid to popularize its start-up platform has not had similar success.

In July 2012, Sebi launched the offer for sale (OFS) method, an exchange-based bidding platform for promoters of listed entities to sell shares in a cheaper, faster and more transparent way than other routes. OFS is now the preferred route for the government to divest its stake in listed public sector units (PSUs).

In the past six years, Sebi has allowed real estate investment trusts (REITs), infrastructure investment trusts (InvITs) and municipal bonds, among others. Though no InvIT has been listed during Sinha’s tenure, there have been six filings so far. The first InvIT is expected to be launched in two months.

Sebi has also carried out significant changes in insider trading and delisting rules, listing norms, the takeover code, and mutual fund regulations.

Mutual fund regulations were revamped in 2012, while the delisting process was automated.

According to Cyril Shroff, managing partner at law firm Cyril Amarchand Mangaldas, Sinha’s tenure has seen the introduction of significant securities markets reforms which have bolstered investor confidence.

In particular, Shroff pointed to the implementation of the 25% minimum public shareholding, introduction of new listing regulations, overhaul of the Takeover Code and the Insider Trading Regulations, changes made to the delisting regime and expansion of the capital markets framework to allow diverse listing platforms.

“As Sinha leaves the corner office at Sebi, he leaves behind a legacy of key reforms which have had and will have consequential impact on the Indian economy," he added.

However, in some cases such as crowd funding, advisor regulations, start-up listing norms and algorithmic trading, experts said the new regulations were not needed.

“Sebi’s faulty regulation-making process has given a series of mistakes in financial markets policy, and creates a risky environment where firms are afraid that something silly will come out next," said Shah.

“It is not the issue of regulations but the environment of the start-up space that has undergone a change," Sinha said in his media interaction.

ALSO READ | Sebi harsh with defaulters and I don’t regret that, says U K Sinha

On the issue of advisor regulations, “there was a loud noise from one section of the market on freedom of speech and we are relooking at the regulations," Sinha added.

Crowdfunding regulations have now been dropped by the regulator.

Rules on HFT are still in the works. Sebi has now appointed an external expert to study HFT and recommend ways to tackle any potential issue arising out of such trades.

According to two people with knowledge of the matter, Ajay Kulkarni, a professor at IIT Bombay will conduct the study at a cost of ₹ 20 lakh.

Sebi is yet to complete action on the long pending case of alleged violation of Sebi fraudulent and unfair trade practices (FUTP) regulations at Reliance Industries Ltd. The unfair access issue at National Stock Exchange of India (NSE) co-location issues is also under examination.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!