Market roundup | Oil investment revival after a two-year rout: IEA

In other news, Indian debt market sees inflows in February, private consumption drives eurozone growth

Premium

Premium

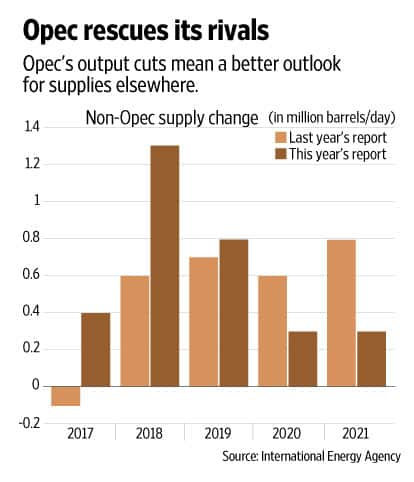

Oil companies are reviving investment after a two-year rout as Opec (the Organization of the Petroleum Exporting Countries) output cuts boost prices, easing but not eliminating the risk of a future supply crunch, the International Energy Agency (IEA) said.

Investment will increase this year after back-to-back declines of about 25% in global investment to $433 billion in 2016, according to IEA, which advises most of the world’s biggest economies on energy policy. The agency had warned in September that investment could drop again this year.

There are “signs of a modest recovery" in spending in 2017 following two years of big investment cuts, the Paris-based agency said in a report on Monday. IEA doubled forecasts for production growth outside Opec next year as US shale producers emerge “leaner and fitter" from the downturn. Bloomberg

Flows return to Indian debt market in February

After experiencing outflows for four months, the Indian debt market received inflows worth Rs5,720 crore in February, largely driven by central government bonds. According to a Nomura report, most of the inflows in central government bonds were seen around the Reserve Bank of India (RBI) policy meeting held on 8 February.

“Foreign investors increased their holdings of central government debt by Rs2,860 crore (3-7 February) ahead of the meeting, and after reducing their holdings by Rs970 crore (8-9 February), they then turned into net buyers again, increasing their investments by Rs2,490 crore," the report said. The foreign participation rate in central government debt increased to 3.31% from 3.2% in January.

However, this remains significantly below the 4% foreign participation rate seen around end-September 2016. Meanwhile, state government bonds also experienced inflows of Rs300 crore, while inflows in local currency corporate debt continued. As per Nomura, this is the first instance of corporate debt receiving inflows in consecutive months since April 2015.

Private consumption drives eurozone growth

Household consumption and a rebound in investment drove economic growth in the eurozone in the last three months of 2016, data from the European Union’s statistics office Eurostat showed on Tuesday.

Eurostat confirmed its earlier estimate that the economy of the 19 countries sharing the euro grew 0.4% quarter-on-quarter and 1.7% year-on-year. It said household consumption added 0.2 percentage points to the final quarterly growth number and capital investment added another 0.1 point, rebounding from a 0.1 point negative contribution in the third quarter. Growing inventories added another 0.1 point and government spending another 0.1 point, while net trade subtracted 0.1 point. Reuters

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!