BSE shares down 17% since listing

BSE shares fell on Friday for the seventh straight session, shedding 3.35% on the National Stock Exchange, or NSE, to close at Rs890.70

Premium

Premium

Mumbai: Shares of BSE Ltd, Asia’s oldest stock exchange, have lost more than 17% since listing a month ago—a fact analysts attribute to its strong opening-day gain that left little room for an extended rally.

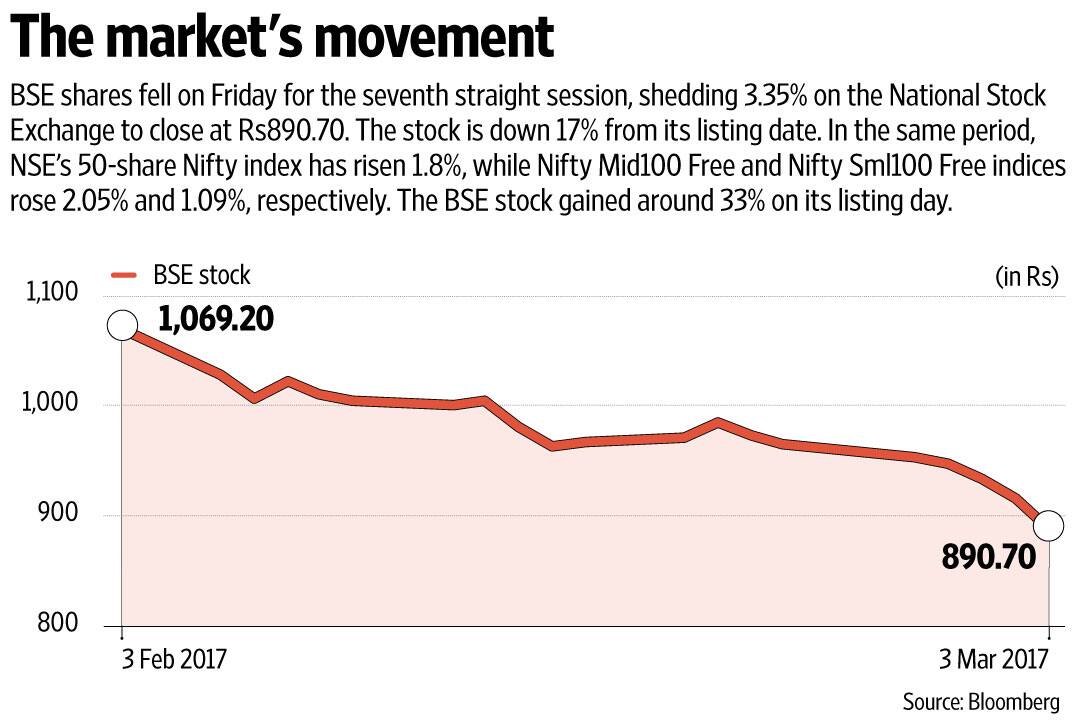

BSE shares fell on Friday for the seventh straight session, shedding 3.35% on the National Stock Exchange (NSE) on Friday to close at Rs890.70.

The stock is down 17.1% from its listing date on 3 February. It is still 10.51% above its issue price of Rs806.

In the same period, NSE’s 50-share Nifty index has risen 1.8%, while Nifty Mid100 Free and Nifty Sml100 Free indices rose 2.05% and 1.09%, respectively.

“The price did not reflect the true fundamentals and growth prospects of the company. It was far ahead of that. It was bound to correct," said Ravi Sundar Muthukrishnan, co-head of research at ICICI Securities Ltd. He sees potential for a slightly more downside than upside for the stock from hereon.

“The talk of NSE listing is also on. Some investors who want a slice of India’s exchange business may prefer NSE when it gets listed over BSE,"said Muthukrishnan, pointing out that the NSE has a dominant market share in the cash and derivatives business in equities.

The BSE stock gained around 33% on its listing day. The stock has risen only in five trading sessions since.

“The stock enjoyed a strong listing, but there has been lack of a fresh trigger post those gains," said Amar Ambani, head of research at IIFL Holdings Ltd.

“The broader market rally is led by the stocks and pockets which hadn’t participated in the rally earlier," said Ambani.

For the BSE stock, the next set of triggers will be the listing of Central Depository Services (India) Ltd, or CDSL, and the NSE, he said.

In December, CDSL filed its draft IPO prospectus with the markets regulator Securities and Exchange Board of India.

BSE, State Bank of India, Bank of Baroda and The Calcutta Stock Exchange Ltd together hold 65.65% stake in CDSL, with BSE alone holding 50.05%.

On 14 February, BSE reported its results for the first time since listing.

The company posted a net profit of Rs63.73 crore in the December quarter—down 16.8% from Rs76 crore a year ago. Revenue rose 8.82% to Rs174.72 crore from Rs160.56 crore.

BSE’s draft prospectus listed 302 shareholders who were selling their shares. Singapore Exchange Ltd sold 5.09 million shares, or a 4.7% stake, to exit the bourse.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!