Escalating North Korea-US tensions rattle Sensex and Nifty, spark sell-off

BSE Sensex closed lower by 190 points, or 0.60%, to 31,702, while the Nifty 50 fell 62 points to 9,913 on North Korea worries

Premium

Premium

Mumbai: Escalating military tensions between the US and North Korea rattled stock markets worldwide, sparking a sell-off in India on Monday. After North Korea tested a hydrogen bomb on Sunday, US President Donald Trump warned that any nation doing business with the regime would have economic sanctions and trade embargoes slapped on it.

Energy from the underground explosion was about six times stronger than the nuclear test of a year ago, South Korea’s weather agency said.

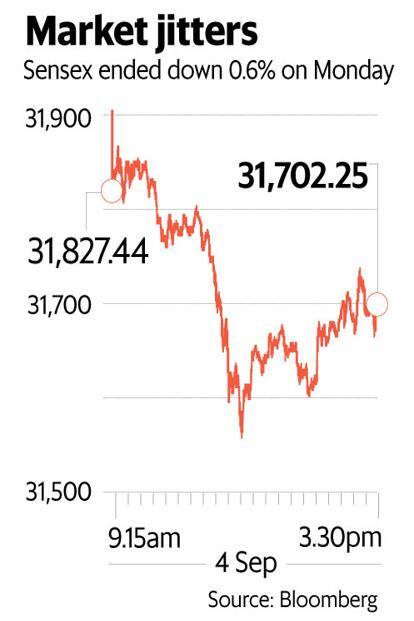

After a sharp fall of 1% during the day, Indian markets recovered slightly at the closing. The BSE Sensex ended at 31,702.25 points, down 189.98 points or 0.6%.

The National Stock Exchange’s Nifty slipped 61.55 points, or 0.62%, to 9,912.85. Among sectoral indices, information technology stocks were the biggest losers, with Infosys Ltd dropping over 2%. The BSE IT index fell 1.02%.

Benchmark indices across Asia lost around 1%, while Europe stocks were also lower during the day. “Equity markets in India traded on a tenuous note today as weakness in global markets coupled with a sharp slide in key index heavyweights impacted investor sentiment," said Karthikraj Lakshmanan, senior fund manager–equities, BNP Paribas Mutual Fund.

“Domestic stocks mirrored the global fall as geopolitical tensions between North Korea and the US reared their ugly head again."

The heightened geopolitical tensions also added to market volatility, with the India VIX index, or the so-called fear index, climbing 14.26% to 13.34 at the closing. In the day, VIX had jumped 19% to 13.96, its biggest rise since 29 September 2016. VIX is an indicator of investors’ perception of a market’s volatility in the near-term.

Since the beginning of 2017, foreign institutional investors (FIIs) have bought a net $7.16 billion of Indian stocks and local mutual funds and insurance companies have invested Rs42,554.28 crore. In August, FIIs sold $1.7 billion, the highest since November, while domestic institutional investors pumped a net of Rs15,695.51 crore in Indian shares.

In 2017 so far, the Sensex has gained 19.6% and the Nifty climbed 21.1%. The MSCI India is up 20.66%, MSCI World has gained 12.25% and MSCI Emerging Markets risen 26.57%.

The geopolitical tension also weakened currencies worldwide. The rupee closed at 64.05 a dollar, down 0.04% from its Friday’s close of 64.03. The 10-year bond yield closed at 6.493%, compared to its previous close of 6.483%. Bond yields and prices move in opposite directions. South Korean won was down 0.61% but Japanese yen was up 0.42%. The dollar index, which measures the US currency’s strength against major currencies, was trading at 92.653, down 0.18% from its previous close of 92.814.

Meanwhile, Prime Minister Narendra Modi sought a strong partnership among Brics (Brazil, Russia, India, China and South Africa) nations to spur growth, saying that the bloc has developed a robust framework for cooperation and contributed to the stability in a world “drifting towards uncertainty", reported Mint.

Addressing the plenary session of the Brics Summit in China’s Xiamen city, Modi said trade and economy were the foundations of cooperation among Brics. He also called for the creation of a Brics rating agency to cater to financing the needs of sovereign and corporate entities of developing countries.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!