Tax saving for singles with no dependants

Go aggressive with equities and add a little fixed income and don't forget a health cover.

Premium

Premium

It’s that time of the year again: when every next call or message is perhaps from a pushy insurance agent. So if you haven’t done your tax planning already and are starting only now, don’t rush and give in to those calls. Pause and first assess what you need. Every stage in life requires a different investment style and tax planning needs to be done in a way that it fits into that style.

Mint Money brings to you a three-day tax special, in which we would deal with tax saving strategies for a single person, for a couple with children and for senior citizens. We start with a single person.

If you are single with no dependants, you have the time and the opportunity to gear your financial portfolio in the right direction. Remember that tax saving needs to find a place in the big picture and not be the main focus of any portfolio.

How do you begin?

You need to start with investments and the tax saving part will come only later. The first step would be to know the purpose or objective of making an investment and accordingly expect or estimate a return. This calls for goal setting. Says Pankaj Mathpal, managing director, Optima Money Managers Pvt. Ltd, “One must always start by linking tax planning instruments with your goals. Once financial goals are in place, you can consider what to allocate under section 80C."

Being single means you have minimal responsibilities—so you don’t have to think of children’s education or a family holiday. Here we are assuming that your parents or siblings are not dependant on you.

At this stage you may have medium-term goals that you want to achieve in three to five years. Says Vineet Arora, executive vice-president, head products and distribution, ICICI Securities Ltd, “Tax saving is not the end objective, it has to be directed towards the overall goal. If a person is single, goals can be simple such as buying a car or a house."

Apart from the short-term goals, your main concern at this stage should be to build a pool of funds for the long term; as and when the responsibilities come on shore, you can start structuring the investments around those. Here are some of the instruments that would help you build a corpus as well as save tax.

What should you buy?

Equity-linked savings schemes: Risk and return go hand in hand. Given that you have no immediate responsibilities, you can afford short-term volatility for long-term gains. In other words, you can have a bulk of your investments in equity.

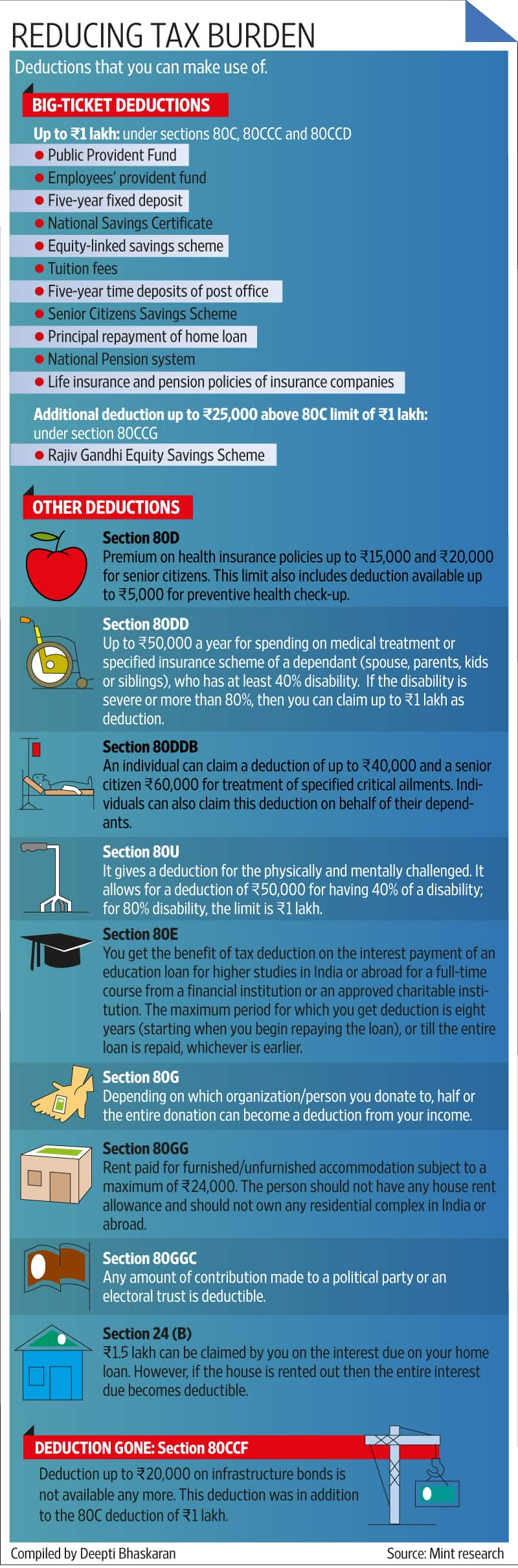

Within equities, mutual funds would be the way to go for most of you since investing in direct stocks would need time and expertise. Here equity-linked savings schemes (ELSS), which are diversified equity schemes and offer deduction under section 80C of the Income-tax Act of up to 1 lakh, would work. This product, however, comes with a three-year lock-in period but at the end of this period, the returns are tax-free.

Says Mathpal, “For those who are single, I would recommend ELSS and some portion which they want to allocate to fixed income can go to Public Provident Fund (PPF). For other instruments such as National Savings Certificate and five-year fixed deposit, the interest earned is taxable hence they are not worth it."

Rajiv Gandhi Equity Savings Scheme: If you earn under 10 lakh and have never invested in equities before, the Rajiv Gandhi Equity Savings Scheme can come in handy. It gives you an additional deduction of up to 25,000, over and above the 1 lakh limit under section 80C, on an investment up to 50,000 in specified stocks or mutual funds. This comes under section 80CCG and like ELSS comes with a lock-in of three years.

PPF: A small portion of your portfolio must go to fixed income instruments, where PPF should be given priority. Those who do not want to take risk even at this early stage can allocate a larger portion to PPF. At the current rate of 8.8% per annum, the tax-free returns at the end of the 15-year lock-in of PPF can form a major part of your retirement corpus. PPF, too, offers deduction up to 1 lakh under section 80C. PPF is now market linked and the returns are subject to change every year. Among retirement tools, the low-cost National Pension System is also recommended. An instrument where you can invest up to 50% in equities, the returns here are not tax-free yet.

Health insurance: Like it is better to start investing early, it is also advisable to buy health insurance as early as you can. Since you are unlikely to have any illnesses at this stage, the cover would come cheaper and would cover all ailments in the future. Buying early could also mean that you accumulate adequate no-claim bonuses.

Arora says, “Protection is of two types, life, which can be taken care by term policy and medical. Now there is an additional benefit for medical insurance of parents up to an amount of 20,000, which is tax deductible under section 80D."

Besides, it offers tax deduction on premiums paid for individuals up to 15,000; the deduction on premiums for senior citizens is 20,000.

Buy a health insurance even if your employer provides one to ensure you have a cover even during job changes.

What to stay away from?

Though insurance policies, the most popular tax-saving instrument, also figure in the 80C basket, you should stay away from those since insurance is primarily meant for those having dependants or a liability.

Says Mathpal, “Typically one only needs term insurance, where the premium is too small to serve the purpose of section 80C. You must always avoid endowment plans and unit-linked insurance plans (Ulips)."

Like health insurance, buying a term plan early would fetch you a high sum assured for a low premium amount. But stay away from endowment policies that come with high costs and little returns. If you do want to invest in Ulips, though mutual funds will serve the same purpose, stay with the growth option for the long-term. Here, too, look at the illustration to understand the costs and commissions of the policy.

And yet, it is common to see people who do not need insurance stuck with high annual premiums. Reva Mary George, a 26-year-old pre-university college professor from Bangalore is a case in point. She has a life insurance product for 37,000 though she has no dependants. Though her parents are retired, they have a pension and enough assets to support them. “I have been thinking of investing in gold and have been asking people about what I should invest in. But as of now, I have not zeroed in on anything yet," says George.

Being unmarried at 26, George needs a life insurance to supplement her earning only if her parents were dependent on her. In her case, after accounting for her employees’ provident fund contribution, the remaining allocation under section 80C should go to ELSS. What she really needs to do is start saving regularly and then investing on a regular basis; the tax-saving products will simply fit into the overall allocation.

What should you do?

Once you know your risk appetite and the products that can cater to that, you would in a better position to choose where to invest. Fortunately, there are tax-saving instruments that can seamlessly fit into your overall medium- to long-term portfolio. Never change your asset allocation to account for tax-saving products.

Tania Kishore Jaleel contributed to this story.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!