Need supply side solutions to solve the household finance problem in India

Indian households rely heavily on gold and real estate, are under-insured, have very little pension corpus build-up, and take home mortgages much later in life

Premium

Premium

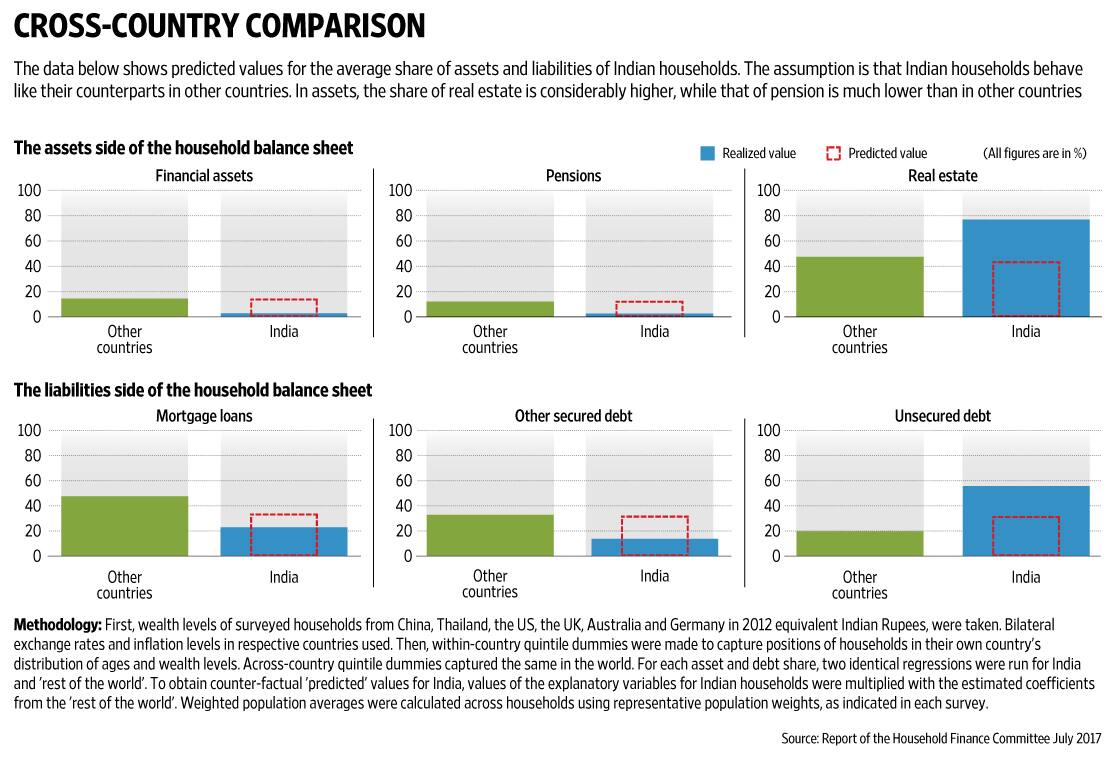

Why Indian households remain in financial behaviour that is ‘regressive’ is a question that has wrinkled the brows of many a policy maker. ‘Regressive’ behaviour is the over-exposure of Indian households to cash, gold and real estate instead of financial assets. This behaviour includes a reliance on the moneylender for debt, rather than the formal financial system, and the use of ex-post borrowings to deal with medical and other emergencies rather than purchasing an insurance contract. With the mandate of the Reserve Bank of India (RBI), the Tarun Ramadorai committee set out to find answers to some of these questions in 2016. While other committees have looked at the same issue of the strange behaviour of Indian households from the supply side and found serious problems in the way formal markets have been set up, the Ramadorai Committee was asked to look at the problem from the demand side and provide solutions to it. In short, the committee found (read the report here: bit.ly/2iC3GKU) that Indian households are indeed globally unique in their financial behaviour. Not only do they rely heavily on gold and real estate, they are under-insured, have very little pension corpus build-up, take home mortgages much later in life than their mature-market counterparts, and walk into retirement still carrying the burden of debt on their heads.

So, are Indian households stupid? No. Just as the other government committees (Swarup committee 2009 bit.ly/2wi1F9O and Bose committee 2015 bit.ly/2gi02oG) found, the Ramadorai committee too finds that it is the supply side that needs to be fixed rather than a massive outreach of financial literacy to fix the demand side. The financial-literacy-is-the-solution approach bounces the ball at the households, making them responsible for their errors. This approach is akin to saying: we can’t make cars that don’t blow up, you learn car engineering and understand what makes a car safe and then you buy a safe car. It is good to see that the Ramadorai committee concludes that the solution is in getting the market right.

The recommendations cover a wide landscape and attempt to pin down the redrawing of a complicated market created by policymakers and regulators—people who sat on defined-benefit pensions, full medical cover from the government, who had little understanding of issues of household finance that even literate urban mass-affluent Indians struggle to solve. I’ll pick a few of the recommendations here.

One, RBI must move the mortgage market from the current marginal cost of funds based lending rate (MCLR)-linked rate system to a repo rate-linked system. This author has argued for a Mumbai interbank offered rate (Mibor)-linked home mortgage system for years. The repo works just as well. Basically, any benchmark that stops the banks from cheating retail borrowers. If you wondered why your loan rate only moves up and never down, here is the reason. Today your loan is linked to a benchmark that a bank controls. The committee recommends that it move to a benchmark that is common to all and not owned by the bank, such as the repo rate.

Two, the National Pension System (NPS) must hike its management charges from the current levels of 0.25% of entry fee and 0.10% per year of fund management charges. It finds that the low levels of NPS use may be linked to its lack of uptake: “This low cap on charges potentially hurts consumer welfare, since distribution incentives may not be sufficient to enable households to fully benefit from the product…."

Three, insurance costs must come down. Incentives in life insurance must be rationalised across the life of the policy. What this means is that the high first-year commissions must be reduced with a greater emphasis on trail. The difference in commissions across different insurance products must be rationalised. This means that the high commissions allowed on traditional plans must be aligned to the lower ones of unit-linked insurance plans (Ulips).

Recommendations two and three contradict each other. If indeed it were front incentives that drove retail participation and persistency in a long-term financial product, surely the 40%+ commissions for over 60 years in the life insurance industry, should have ensured that India be a fully insured country by now. I wish the report would have taken note of the experience of Indian mutual funds that went no-load in 2009 and have seen evidence of increasing retail participation built on a trail model to inform the recommendations. Policymakers should leave NPS alone—it is a good product in a bad market. Instead of fixing the bad market we want to fix the ‘goodness’ of the NPS product.

Four, better disclosures in a manner that people can understand in life insurance and a clamp down on mis-selling of traditional products. If you remember, in 2010 Ulip rules were changed to take the monkey of huge costs and the ability of the insurance firm to keep all of the investors’ money in case of lapsation in the first few years. The committee is recommending the same for traditional plans.

Five, to wean people from gold, the committee wants the government to issue inflation-indexed bonds and make gold more demat with the help of a gold registry. To tackle issues of gold being a sump of black money, link gold purchases even below Rs2 lakh, to a Permanent Account Number (PAN).

Six, the market should be clearly divided between distribution and advice. A distributor can only vend products for a transaction cost or trail commission paid by the product manufacturer and cannot advise consumers. An adviser is a fee-for professional who is paid by the consumer directly. Each adviser must have a unique identification number and there must be a self-regulatory organization (SRO)-driven regulatory system for financial advisers.

Seven, there must be uniformity in the financial adviser industry. There cannot be different norms around costs, behaviour and rules for different financial products. Insurance intermediaries must be brought under this uniform SRO-driven advisory regulatory framework with the advisory and distribution functions effectively segregated. If implemented in spirit, this will mean that the insurance agent will just vend the policy and not ‘advise’, moving pure sales effectively online. Insurance advisers will have to agree to a fiduciary standard and that means putting the customers’ interests above their own. Long road there.

Eight, to remove the high on-boarding costs due to Know Your Customer (KYC) requirements, the Committee wants a standardisation of rules and guidelines around e-KYC.

Nine, a rights-based approach to be used to ensure privacy of data generated in a digital-heavy financial system. This means that digital exhaust of a consumer must belong to her and not the firm that sells a product or a service. Right now, there is Wild West in the space with some bank apps taking perpetual rights over digital data of their consumers.

Ten, an essential financial kit with simple products to be made available, linked to Jan Dhan accounts. This will have a no-frills savings account, a target date investment product, flexible fixed deposit schemes, micro pensions, simple term life insurance, basic health and catastrophe insurance, micro credit, simple collateralised loans, and a good reserve mortgage product, among others. This is a tall ask and just implementing this will take years of work. But at least we know what a simple money box looks like.

Last, there is a recommendation that regulators use the ‘sandbox’ approach to test new technologies, products and processes. This is a technique being increasingly used across the world to introduce something new in the market in a controlled environment to see how it works. It is a good suggestion, but I wish the committee had asked for financial literacy modules for regulators first. I’d like to know how many of the regulatory staff would see images of a child’s playpen when they hear the words sandbox.

There are recommendations on better data collection and disclosure of this data across the report. I wish the committee had gone one step further and asked the Government to work on a common protocol for data collection, saving and disclosure. Privacy rights, the use of machine readability and relevance of the data collection to various stakeholders are issues that can be solved once for the whole country using a principle-based approach and then individual regulators can use the matrix for their own pieces of the market.

This comprehensive report must be taken seriously by policymakers, governments and regulators. It is the third report in a decade to say the same thing—fix the supply side. Decision makers, sitting in high towers of isolation, must stop blaming households for their own failures. If the market is failing, it is not because people are stupid. It is because you have created a regulated market that is unreachable, high-cost and treacherous. People are just being smart to stay safe in cash, gold and real estate.

Disclosure: The author deposed before the Ramadorai committee, was a consultant to the Swarup committee and a member of the Bose committee.

Monika Halan works in the area of consumer protection in finance. She is consulting editor, Mint, and on the board of FPSB India. She can be reached at monika.h@livemint.com

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!