Budget 2017: Ten things to look out for

The impact of demonetisation on economic growth, fiscal deficit, and jobs and taxes are set to feature prominently in Arun Jaitley's budget speech

Premium

Premium

1. Carrying forward the demonetisation initiative

The Union Budget 2017 will be unveiled under the shadow of the government’s demonetisation of high-value notes. The government has said time and again that demonetisation is a first step in the move to flush out black money. Taken by itself, demonetisation is certainly not enough to unearth unaccounted wealth. All eyes will, therefore, be on the budget speech, to see how the process of tackling unaccounted wealth will go forward. The estimates of black money unearthed by demonetisation may also be furnished along with details of how the tax base is being broadened, as the government has been claiming. The budget speech could include incentives given for moving to digital payments as well as for moving from the informal to the formal sector, another declared objective of the government.

ALSO READ | Modi’s note ban leaves scant room for Arun Jaitley’s budget giveaways

2. Growth

The government has downplayed the impact on growth of the demonetisation exercise, claiming that its negative impact has been far less than what the pundits have been estimating, and that it’s temporary. The government’s estimate of nominal growth in FY18 will, therefore, be watched carefully. The economy was in recovery mode before being hit by the demonetisation bouncer, and the government believes it will soon get back to form.

There are some risks to growth in FY18, however. One, the boost to growth from lower crude oil prices will not be there. Two, the environment of rising protectionism is not conducive for export growth. The burden of reigniting growth, therefore, falls almost entirely on domestic demand. And if there is a long-term impact on the informal economy disrupted by demonetisation and the goods and services tax (GST), it could lower demand.

3. Investment

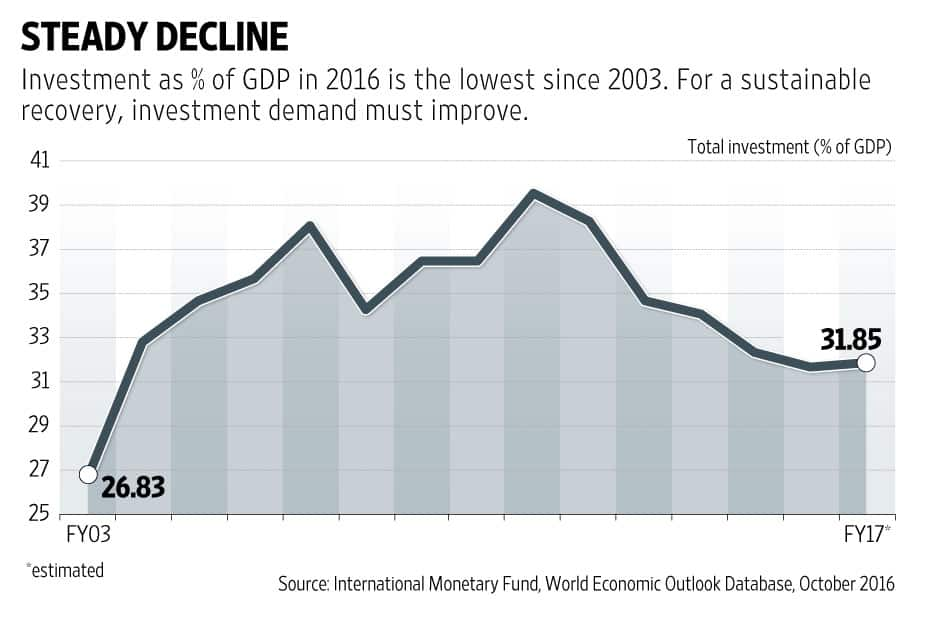

The chart shows the steady fall in the economy’s investment/gross domestic product (GDP) ratio after reaching a peak in 2011. Getting investment back on track is necessary for a sustained revival of growth. Unfortunately, the government’s capex this fiscal for April-November is 10% lower than in the same period of the previous year, as the government had to spend on the implementation of the 7th Pay Commission recommendations and on increased military pensions.

True, much of the government’s capex has been through borrowing by agencies such as the National Highways Authority of India (NHAI); but as the chart shows, it doesn’t seem to have made much of a difference. Perhaps, the main reason is the lack of private investment. The budget will be scrutinized to see whether it gives an impetus to investment.

4. Consumption

Government spending on roads and railways and other infrastructure is preferable to boosting consumption, because a big stimulus to consumption runs the risk of igniting inflation, particularly if oil prices remain high. That said, many analysts believe the government will boost consumption, particularly through rural spending.

ALSO READ | Modi may lower taxes to spur demand in his budget sops

The budget will tell us whether the government is going to shift its focus to populism, in preparation for the 2019 elections. True, the only way to revive private capex is to increase consumption, which will reduce excess capacity and ultimately lead to investment demand picking up. But if the government is right about the temporary impact of demonetisation and consumption is expected to bounce back soon, why do we need to boost it?

5. The fiscal deficit

As in the earlier years, this year, too, there’s a lot of talk about postponing the fiscal consolidation targets. Much depends on what the N.K. Singh committee recommends. It’s important that the centre’s fiscal deficit is reduced, for the simple reason that states may not be able to reduce their deficits as they implement the pay commission recommendations in FY18. Moreover, if the government claims demonetisation hasn’t really hurt the economy, it cannot simultaneously argue that a fiscal stimulus is needed. The target of 1.8% for the FY18 revenue deficit, in particular, needs to be met.

6. Taxes

This budget may dramatically change the pace of tax reform. Tax rates on individual tax payers could be reduced or at least the threshold and tax brackets changed to provide incentives for declaring income and, perhaps, to boost consumption. Rationalization of corporate taxes will continue and should be aimed at reviving drooping corporate spirits. This is not the time to tinker with capital gains taxes.

7. Jobs

This should perhaps be the No. 1 objective if the government wants to avoid a social and political backlash. That will involve supporting agriculture, but there’s not much the central government can do there. Instead, it must find ways of reviving the construction sector, a big source of jobs. Growth in the construction component of gross value added has been falling steadily from 4.6% in 2013-14 to 4.4% in 2014-15 to 3.9% in 2015-16, while the Central Statistics Office estimates growth of 2.9% this year, and it’s likely to be lower. The prime minister, in his New Year’s eve address, had talked of a boost to low-cost rural housing, which could lead to lots of jobs. The budget will tell us whether the government is putting its money where its mouth is.

ALSO READ | Arun Jaitley likely to cultivate farmers with budget sops

8. Subsidy reforms

The run-up to the budget has seen a lot of trial balloons being floated about a universal basic income. The budget will tell us whether a beginning is made towards it. Changes in fertilizer and liquefied petroleum gas (LPG) subsidies, if any, and signs of progress towards direct benefits transfer will also be awaited.

9. Banking system

The banking system remains the Achilles heel of the Indian economy and although banks’ profits may have gone up due to treasury gains, demonetisation may have led to more distress among industries, especially small-scale industries that could result in an increase in bad loans. The budget will tell us whether the government will do more to recapitalize banks.

10. Administrative reforms

The slogan of ‘minimum government’ seems to have been forgotten and the reform of the bureaucracy and talk of a smaller government has been put aside. A. Prasanna, economist at ICICI Securities Primary Dealership, says fundamental changes are needed in the bureaucracy and in labour laws and regulations. It’s doubtful if any of that will happen, and this budget could finally lay to rest any hopes on that front.

Manas Chakravarty looks at trends and issues in the financial markets. Respond to this column at manas.c@livemint.com.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!