RBI’s annual report: Raghuram Rajan says India’s growth below potential

RBI governor Raghuram Rajan lists economic growth, curbing inflation, clean-up of bad loans in the banking sector as key 'work in progress' areas

Premium

Premium

Mumbai: The economy’s prospects for the current financial year are brighter than the previous fiscal, but growth is still below potential, wrote Reserve Bank of India governor Raghuram Rajan in his foreword to the central bank’s annual report for 2015-16.

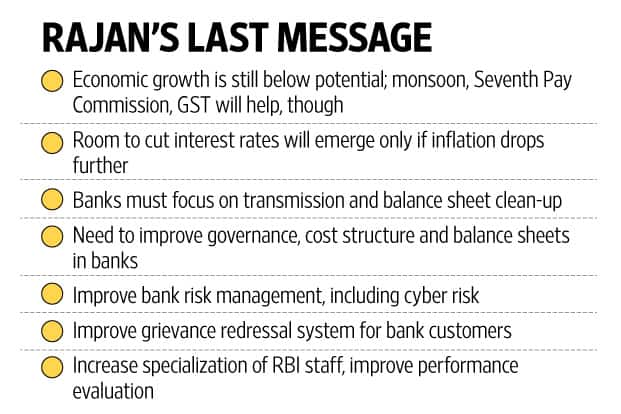

A week before he hands over charge to Urjit Patel, Rajan listed economic growth, curbing inflation and ensuring that banks focus on rate cut transmission and balance sheet clean up as the key “work in progress" areas for the central bank.

On economic growth, the governor said that a “virtuous cycle of growth is possible, reinforced by anticipation of the coming benefits from reforms like the recently passed goods and services tax legislation in Parliament".

A good monsoon that will lift sagging farm output and the pay commission award for government employees which will boost consumption are expected to lead to a pick-up in demand, said the central bank.

RBI has increased its projection for gross value added (GVA) growth by 30 basis points (bps) this financial year to 7.6%. A basis point is one-hundredth of a percentage point.

“Overall GVA growth is, therefore, projected at 7.6% in 2016-17, up from 7.2% last year. A better than anticipated agricultural performance and the possibility of allowances under the seventh pay commission’s award being paid out in Q4 of 2016-17 provide upsides to this projection," the annual report said.

In the report, the central bank said good rains this year have resulted in a 6.5% increase in sowing of the monsoon crop. This is in line with RBI’s latest round of professional survey, which forecast agriculture output growth at 3% for fiscal 2017. In addition, the government is also expected to pay out as much as ₹ 1.02 trillion as allowances under the Seventh Pay Commission by the fourth quarter this year.

ALSO READ | RBI Annual Report 2015-16: Consumption will drive growth this year

“We have been saying that if the agricultural sector shows growth due to better monsoon, it should improve the GDP number by about 50 bps, so we would concur with the RBI governor’s views on it," said Soumya Kanti Ghosh, chief economic adviser to State Bank of India. “However, when linking these factors with ground realities such as damp credit growth, banking sector health and weak job market, we can say that the turnaround in the economy will be a gradual one."

In its report, the central bank said faster clearances of stalled projects have boosted the overall business sentiment. Sectors such as roads and ports have seen significant improvement, with private ports seeing the highest ever capacity utilization in a single year. However, a major turnaround in industrial output is still some time away.

The second major challenge that Rajan highlighted is inflation. According to Rajan, inflation projections are still at the upper limits of the central bank’s inflation objective of 4% in the medium term.

“With the Reserve Bank needing to balance savers’ desire for positive real interest rates with corporate investors’ and retail borrowers’ need for low nominal borrowing rates, the room to cut policy rates can emerge only if inflation is projected to fall further," wrote Rajan.

It is widely expected that the monetary policy committee—it will be constituted under the terms of the government’s agreement with RBI—will decide on the next monetary policy in October.

The “tone of annual report shows a small room for a rate cut in the third quarter", said Shubhada Rao, chief economist, Yes Bank.

ALSO READ | RBI Annual Report 2015-16: Household financial savings rise

According to the outgoing governor, stressed assets will be the third area of focus in the near term. While banks have recognized bad loans on their books, the focus should now move to improving operational efficiency of stressed assets and creating the right capital structure so that all stakeholders can benefit, he said. Rajan said debt restructuring schemes such as the strategic debt restructuring scheme and the scheme for sustainable structuring of stressed assets were facing difficulties because banks are using them to postpone recognizing bad assets rather than using them to change the management or capital structure of the stressed borrower. RBI will continue monitoring to see that these schemes are used as warranted, he added.

Over the medium term, said Rajan, there is a need to increase efficiency in the financial sector through greater entry and competition. A critical component would be to strengthen public sector banks in all aspects, including governance, cost structure, and balance sheets, he said.

Another intent is to strengthen risk management, including cyber risk. RBI’s supervision will look into all these aspects and also strictly enforce penalties for non-compliance with regulations or remedial action plans.

The regulator will also try setting up a more refined grievance redressal system for customers through banks as well as the regulator. Rajan also said that the bank will “focus this year on the issue of mis-selling, especially of insurance products".

Other agenda for the year

Other measures the central bank is planning for the current financial year include introducing money market futures to further develop the rupee futures market, reviewing the existing framework for hedging commodity price risk and setting up an appropriate ombudsman scheme for the non-banking finance sector. The central bank has also said that it will immediately implement three recommendations of the committee on medium-term path on financial inclusion. These include creating a business correspondent registry, formalizing certification and training for these entities and accrediting credit counsellors. The central bank also talked about exploring introduction of interest-free products, since “some sections of the Indian society have remained financially excluded for religious reasons that preclude them from using banking products with an element of interest".

Balance sheet

RBI’s balance sheet expanded 12.25% in the year ended June and it transferred a surplus of ₹ 65,876 crore to the government.

On the assets side, this expansion in the balance sheet is almost completely explained by the increase in both foreign and domestic investments. Domestic investments rose slightly faster than foreign, and the share of foreign currency assets (including gold) eased slightly to 75.41% of all assets from 78.14% last year. Meanwhile, a part of the increase in foreign exchange reserves is attributable to gains in revaluation, owing to depreciation of the rupee against the US dollar and rise in the price of gold. The currency and gold revaluation account alone contributed to 22% to the overall increase in RBI’s balance sheet over the year.

ALSO READ | RBI’s FY16 annual report: Five key takeaways

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!