Surge in credit not benefiting small farmers

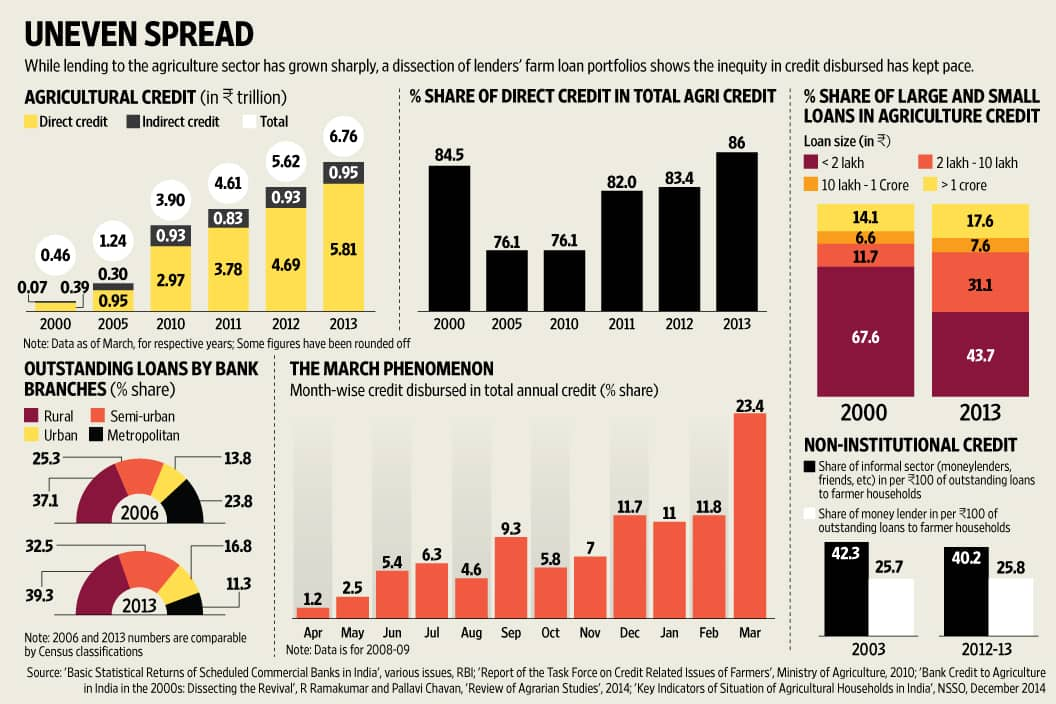

Loans less than Rs2 lakh comprised only 44% of total credit disbursed in 2013, down from 68% in 2000

Premium

Premium

New Delhi: Is the surge in farm credit iniquitous? Only 44% of advances are small loans to farmers. The formal credit market may have deepened, with the banked farmer availing more loans, but the informal sector is still holding fort.

Credit to the agriculture sector has grown sharply in less than a decade—from more than ₹ 1 trillion in 2005 to nearly ₹ 7 trillion in 2013. The Union Budget this year set an ambitious target of ₹ 8.5 trillion for 2015-16. However, a dissection of farm loan portfolio of lenders shows that the inequity in credit disbursed has kept pace with the quantum leaps—the share of loans above ₹ 10 lakh is going up and over a quarter of the credit is advanced from urban and metropolitan branches of banks, unlikely places for a farmer to avail a crop loan.

Moreover, in the decade between 2003 and 2013, the share of informal sector in loans to agricultural households has been steady at around 40%, implying that those who have availed a loan may be getting more loans, but ignoring those who still depend on the professional moneylender.

Loans less than ₹ 2 lakh, the most likely amount to be borrowed by a small or marginal farmer, comprised only 44% of total loans in 2013, down from 68% in 2000. In comparison, loans of more than ₹ 10 lakh comprise more than a quarter of the agricultural credit disbursed, compared to 21% in 2000. The declining share of small loans could be due to banks’ reluctance to lend to the small farmer, further accentuated by inherent risks (say, deficit or unseasonal rains) associated with farming. Partly, the decline could also be due to rising costs of cultivation, inflationary pressures, and more people moving out of farming (between 2001 and 2011 more than 8.6 million left farming).

Worryingly, banks lent over 46% of agricultural credit between January and March— perhaps to meet year-end targets —although farm loans are most likely required before the crop season begins, around June and November. Data on what is called the “March phenomenon" is scant; the Reserve Bank of India does not publish month-wise credit disbursed and the only source is a ministry of agriculture task force report from 2010, giving out the numbers for 2008-09. In such a scenario, what is confounding is that the share of indirect credit to agriculture hasn’t changed much. Large-sized loans taken by input dealers, agri-businesses such as food and agro-processing industries and warehousing companies, most likely to be advanced by urban and metro bank branches, fell marginally from 15.5% of farm credit advances in 2000 to 14% in 2013.

Direct credit to individual or groups of farmers, as short-term crop loans and long-term loans for fixed capital investments, still constitute 86% of the total credit to the agriculture sector. However, from 2013, loans less than ₹ 2 crore to corporates, partnership firms and farmers’ producer companies engaged in agriculture and allied activities are treated as direct credit. This could have dressed up the direct credit numbers.

“Banks are more than happy to lend large amounts to fewer accounts. Small loans to a large number of farmers entail higher transaction and administrative costs alongside the risks associated with farming," said R. Ramakumar, professor at the School of Development Studies, Tata Institute of Social Sciences in Mumbai. “The share of direct credit to agriculture rose after 2010—but other indicators like the rising share of large loans and the diversion away from rural areas show the correction is illusory," he adds.

Preliminary reports from the National Sample Survey Organisation (NSSO) study Key Indicators of Situation of Agricultural Households in India, released in December, amply proves that the surge in agricultural credit in the last decade did not benefit farm households.

More than 40% of credit to farm households were advanced by informal sources in 2012-13- with the moneylender advancing 26% of the outstanding credit. For households with the smallest landholdings, only 15% loans were from institutional sources.

These numbers are hardly any improvement over 2003, when NSSO conducted the first such survey: back then, informal loans accounted for 42% of credit advanced to agricultural households. “What seems to have happened is a deepening of credit market with the same set of borrowers. Earlier, they were taking smaller loans and now they are taking larger loans. But the credit market has not broadened to include, say, the marginal and tenant farmers," said Himanshu, associate professor at Centre for Economic Studies and Planning, Jawaharlal Nehru University, Delhi, and a Mint columnist. “The marginal farmer was mostly out of the formal credit sector and this was not corrected by the surge in agriculture credit," he adds.

This story has been modified from its previous version to reflect a correction.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!