Will Apple be the first to reach $1 trillion market capitalization?

Apple, the company that Steve Jobs founded, lost and re-found is now within touching distance of becoming the first company to achieve a market capitalization of $1 trillion

Premium

Premium

In 2017, it teased with that question. In 2018, it looks set to answer it. As of 13 December, the market capitalization—what it would cost to buy a listed company—of Apple Inc. was $884 billion. The company that Steve Jobs founded, lost and re-found is now within touching distance of becoming the first company to achieve a market capitalization of $1 trillion. Apple is unlikely to unfurl a game-changing product soon, which it did time after time under Jobs, but it has a solid, stable product and services portfolio that is wired for new revenue and profit growth in 2018.

Market cap: a cut above the tech cream

Of the top five stocks by market capitalization, Apple is a clear leader over Alphabet Inc. (Google). In 2017, Apple gained 45%—the third most, after Amazon.com Inc. and Facebook Inc. It needs to gain another 13% to breach $1 trillion in market cap.

Revenue: iPhone replacement demand and services

Even as services emerge as a new pocket of growth, the iPhone remains Apple’s mainstay, accounting for 62% of revenue in 2017. According to research firm GBH Insights there are about 350 million users with iPhone models that are at least two years old. It expects a significant percentage of them to upgrade to iPhone 8, iPhone 8 Plus and iPhone X, enabling Apple to top the 231 million units it sold in 2015; plus, the iPhone X, launched to mark the iPhone’s 10th anniversary, will help Apple earn higher margins.

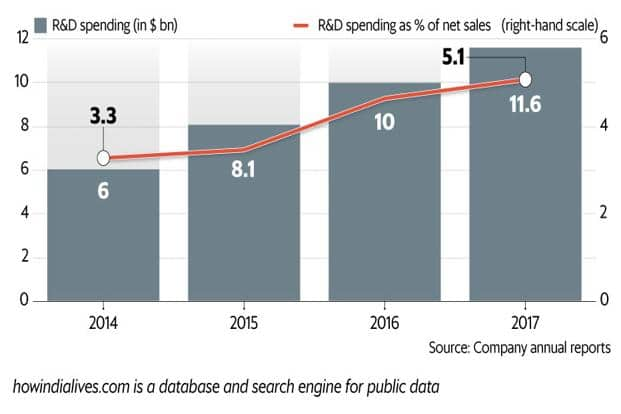

R&D spending: double in last 3 years

In the last three years, Apple has nearly doubled its expenditure on research and development (R&D). In 2017, it has spent $11.6 billion, a high of 5.1% of net sales. It has also been making acquisitions in spaces such as virtual and augmented reality, auto and music experience. Even as the wait continues for the next Apple breakout product, all these areas will add weight to its current core.

howindialives.com is a database and search engine for public data.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!