Infosys struggles to sell distressed asset Panaya

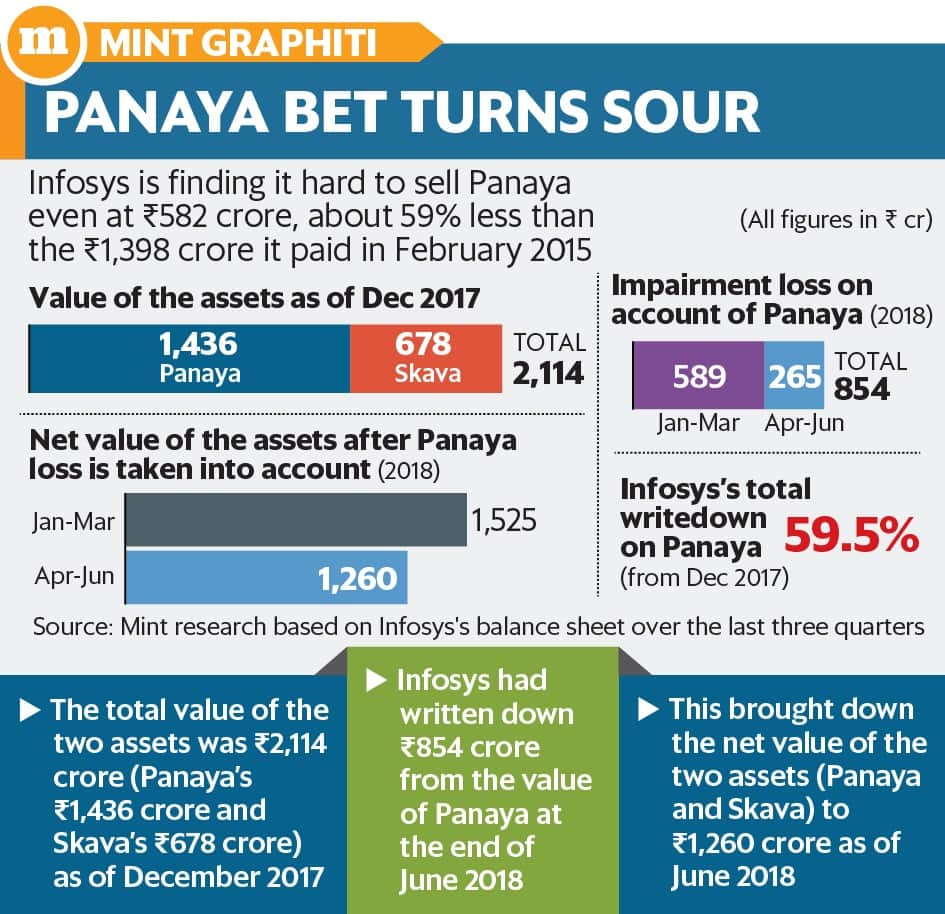

Infosys is finding it hard to sell Panaya even at ₹582 crore, about 59% less than the ₹1,398 crore it paid in February 2015

Premium

Premium

Bengaluru: Back in February 2015, Infosys Ltd’s then chief executive Vishal Sikka hailed the firm’s $220 million (₹1,398 crore) purchase of Panaya, calling the Israeli firm’s offerings “an awesome piece of technology."

A little over three years on, that bet has soured for Infosys, as India’s second largest outsourcing firm scrambles to find buyers for the Israeli automation technology firm that is now valued at less than half the price Infosys paid for it.

Less than two months after it purchased Panaya, Infosys spent $120 million to buy Skava, a US-based mobile commerce firm, in April 2015. Earlier this year, Infosys decided to sell both Panaya and Skava. For now, Infosys has not marked down the value of Skava.

Executives familiar with the Panaya sale have described it as “a fire sale" of sorts, given its latest valuation of ₹ 582 crore—a 59% discount on the purchase price of ₹ 1,398 crore ($220 million).

Infosys disclosed the fair value of Panaya in its balance sheet for the June quarter.

According to the executives cited above, if Infosys does not find a buyer quickly, there could be further write-downs over the next few quarters.

Infosys’s decision to admit the loss in value of Panaya is a clear admission that the acquisition has not worked out for the company in the way it had originally envisioned, according to experts.

“Infosys is just not set up to sell products effectively—and it took Sikka a while to realize this. Moving to digital is much more in line with the strengths of the firm as a tech agnostic services business. Skava and Panaya were a mistake and they just need to write down whatever they can and move on," said Phil Fersht, CEO of US-based HfS Research, an outsourcing-research firm.

Infosys’s purchase of Panaya has been at the centre of a number of controversies under the previous management. One such was Infosys’s decision to pay a generous severance payout to former chief financial officer Rajiv Bansal, which Infosys founder N.R. Narayana Murthy had objected to.

“Now, due to a regime change at the firm, with both a new management and a new chairman, the firm is realising that it is not getting the value on what it has paid earlier and that it had overpaid earlier," said Shriram Subramanian, founder of proxy firm InGovern Research.

Infosys declined to offer a comment, with a spokeswoman saying the firm does not have anything to add to what the management has already said.

“As part of our strategic review, we put together a set of criteria for our entire portfolio. When we looked at Skava and Panaya, they did not meet that criteria. We then decided to take the actions that we’ve taken," Infosys’s current CEO Salil Parekh said in April.

Over the past three years, the Panaya acquisition has been a hot-button subject for Infosys and was a central plank for much of the criticism that was levelled against the company by its founders, based on an anonymous whistleblower complaint which alleged wrongdoing by the previous management on the Panaya deal. Infosys’s earlier board conducted two investigations and absolved the management of wrongdoing although the firm to this day has not made the probe report public.

Infosys and Sikka in the past have also repeatedly denied any wrongdoing with regards to the acquisition.

“Infosys just needs to tell which of the three answers best explains the reason behind this loss in value of Panaya. First, is this loss because the transaction done by the earlier management was not at arm’s length? Or is it second, that Infosys was not able to handle this acquisition well? Or is it third, that Infosys’s current management and the board decided to settle scores with the old management and the board,," said J.N. Gupta, co-founder of Stakeholder Empowerment Services, a proxy advisory firm.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!