India Inc’s policies for supply chain not robust

With most firms ignoring chinks in the supply chain, issues such as employee strife over wages or unsafe work conditions can derail operations

Premium

Premium

In 2013, the eight-storeyed Rana Plaza in Dhaka, Bangladesh, collapsed, killing over 1,100 garment workers. Major global apparel makers such as GAP Inc., Wal-Mart Stores Inc. and Children’s Place Inc., along with many others, drew flak. In their bid to source low-cost clothing, the brands had ignored the working conditions of the people from whom they sourced their goods.

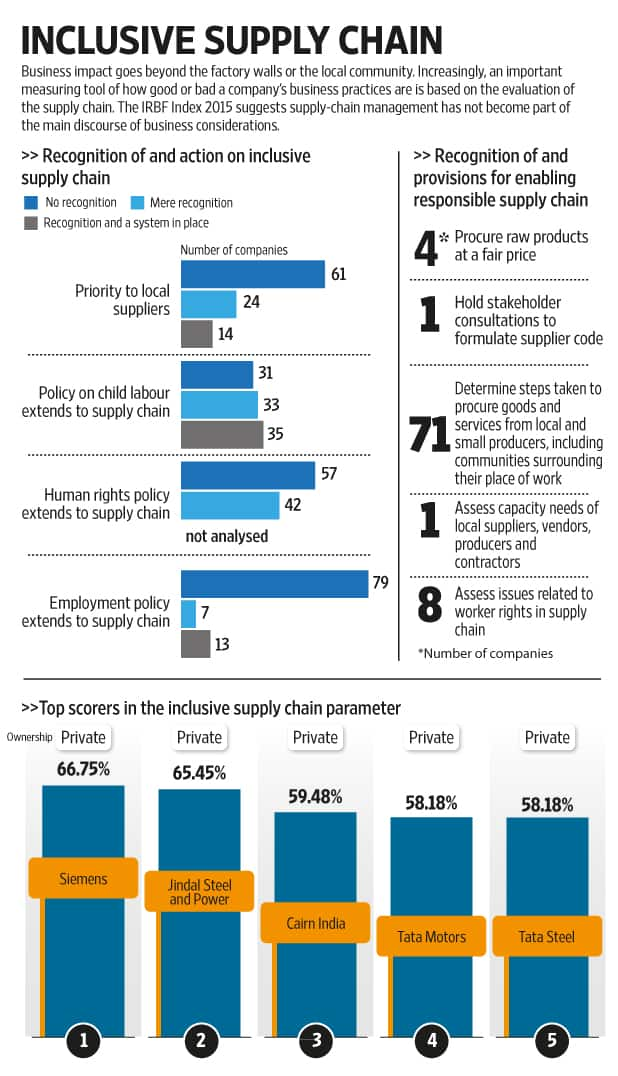

The incident underscores the need for a sustainability policy for supply-chain partners. Till date, India has not made much headway on it. The India Responsible Business Forum (IRBF) Index 2015, an initiative by Oxfam India in partnership with Corporate Responsibility Watch, Praxis and Partners in Change, shows that firms do not hold suppliers to the same standard they expect from their own organizations.

Documents of 99 companies available in the public domain such as annual reports, sustainability reports and business responsibility reports, among others, were used to draw up the index. According to the index, 61 companies did not acknowledge local suppliers, and an overwhelming 79 did not extend their employment policies to their supply chain.

“A handful of Indian companies have the concept of a responsible supply chain. In fact, many of the companies are waking up to sustainability practices only now, so it’ll take time for it percolate down to their suppliers as well," said Santhosh Jayaram, director (sustainability practice) at KPMG India.

Capital markets regulator Securities and Exchange Board of India (Sebi) in 2012 suggested that the top 100 BSE-listed companies include a business responsibility report (BRR) with their annual reports. A BRR is a voluntary disclosure of the extent of adoption of responsible business practices, in line with those mentioned in the National Voluntary Guidelines drawn up by the ministry of corporate affairs in 2011.

Under a BRR, a company is expected to list all the activities that it is undertaking and the processes it has put in place to encourage its supply-chain partners to embrace practices such as fair and minimum wages, employee health and safety and reduced environmental footprints.

While companies lag with regard to most parameters of supply-chain management, when it comes to procuring from local and small producers, they have done reasonably well. Seventy-one have systems under which they procure goods and services from local and small producers.

Tata Motors Ltd is one such company, with as many as 1,000 suppliers. At all its seven manufacturing plants across the country, it sources material from the auto hubs in the respective region.

“We’ve set up dedicated vendor parks at Sanand (Gujarat) and Pantnagar (Uttarakhand) to help establish the supply chain base at these greenfield locations. This has led to the growth of the local economy while reducing logistic complexities and minimizing packaging and transportation costs," said a Tata Motors spokesperson.

With most companies ignoring chinks in the supply chain, issues such as employee strife over wages or unsafe work conditions can derail operations and impact business. Sectors such as manufacturing and consumer goods rely heavily on supply-chain partners. Those like banking and financial services don’t, the index shows.

“The argument is banks and financial sectors don’t leave a major footprint and are not a high-risk sector," said Nusrat Pathan, CSR head at HDFC Bank Ltd. Still, the bank formalized a policy in 2012 for sustainability across the value chain. This means sustainability practices are expected both of vendors they deal with and customers.

For banks, vendors include their IT vendors, security staff and asset providers such as ATM manufacturers. Pathan said that when contracts are drawn up with a vendor, the bank has processes in place to check if it meets minimum-wage norms, does not employ children and complies with all environmental norms.

Even though having a sustainable supply chain has its benefits, there are challenges as well.

According to Jayaram of KPMG, the biggest hurdle is to get the suppliers to adopt it. “Most suppliers are small and medium enterprises and to get them to adopt best practices is a challenge. Only when more companies add sustainability as a requirement will suppliers take this seriously," he said.

Globally, companies are many steps ahead. They have moved from screening suppliers to capacity building, Jayaram said. And since many Indian companies are supplying to global companies, they are increasingly exposed to global standards. So, it is a matter of time before Indian companies and suppliers begin to share the same standards of sustainability, he said.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!