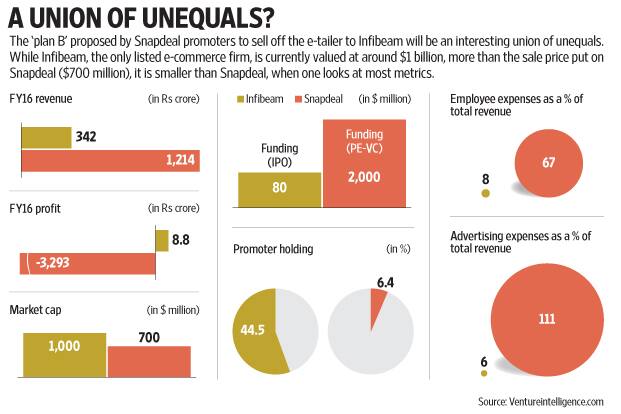

Will a Snapdeal-Infibeam merger be a union of unequals?

While Infibeam is valued at around $1 billion, it is smaller than Snapdeal when one looks at most metrics

Premium

Premium

New Delhi: The proposed ‘Plan B’ by Snapdeal founders Kunal Bahl and Rohit Bansal to sell off the erstwhile e-commerce unicorn to Infibeam will be an interesting union of unequals.

While Infibeam, the only listed e-commerce firm, is currently valued at around $1 billion, more than the sale price put on Snapdeal ($700 million), it is smaller than Snapdeal, when one looks at most metrics.

In FY16, Snapdeal’s revenue was four times that of Infibeam. Snapdeal has also raised $2 billion so far, compared to Infibeam’s $80 million.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!