Telecom companies look set for another good year

Apart from the improvement in tariffs, telecom investors are also pleased with the govt's decision to lower the reserve price for the 2G spectrum auctions

Premium

Premium

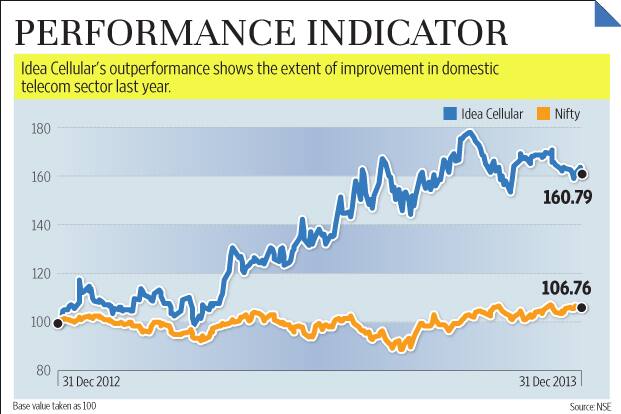

Idea Cellular Ltd’s shares rose by more than 60% in 2013, beating the 7% return in the Nifty by a long margin. This is largely because of the easing of competitive intensity in the sector and the gradual improvement in tariffs. While financial results in the past couple of quarters have looked up, things are expected to improve further in 2014.

Rising tariffs are expected to result in high earnings growth because of the industry’s high operating leverage. Analysts at Barclays Research said in a recent note to clients, “Competition has come off due to high leverage, and we have now witnessed two quarters of rise in RPM (revenue per minute). Building a modest (approximately 3-5%) improvement in RPM over next four quarters, we believe that high operating leverage of telecom companies could lead to an EPS (earnings per share) CAGR (compound annual growth rate) of 48-65% over the next three years for the three listed mobile telecom players in India."

Apart from the improvement in tariffs, telecom investors are also pleased with the government’s decision to lower the reserve price for the 2G spectrum auctions. The Barclays analysts add that, in addition, the initial M&A (mergers and acquisitions) rules announced by the government are reasonable, suggesting a marginal improvement in the regulatory environment. Needless to say, one of the biggest risks for the sector comes from the regulatory side, and although this hasn’t gone away completely, things are much better compared to a year ago.

Investors will also eagerly look for clarity on Reliance Industries Ltd’s strategy for the telecom market; an aggressive entry can upset analysts’ calculations meaningfully. Another factor to watch out this year will be the growth in the data business, and how this will impact other revenue streams such as SMS (short messaging service) and voice. Of course, the impact is expected to be very gradual; even so, it makes sense for investors to watch out for any trends on this front.

By and large, however, 2014 can be expected to be another year of strong earnings growth, backed by higher tariffs and the reduced threat of price competition.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!