Govt can’t take away RBI reserves without amending RBI Act

Under Section 47 of the RBI Act, only surplus profits can be transferred, and transferring reserves will require an amendment to the Act

Premium

Premium

Mumbai: The government cannot force the central bank to part with its reserves without an amendment to the Reserve Bank of India Act, 1934, a person aware of the matter said. Under Section 47 of the RBI Act, only surplus profits can be transferred, and transferring reserves will require an amendment to the Act.

Section 47 says that “after making provision for bad and doubtful debts, depreciation in assets, contributions to staff and superannuation funds and for all other matters for which provision is to be made by or under this Act or which are usually provided for by bankers, the balance of the profits shall be paid to the central government".

In 2017-18, RBI had transferred ₹ 50,000 crore of its surplus to the government, the highest since 2015-16.

The person cited above said on condition of anonymity that the RBI board has been giving broad policy directions to the bank and while it can form regulations, these will have to be passed by both Houses of Parliament. According to section 58 (4) of the RBI Act, every regulation made by the central board should be first sent to the government. The government will then have to send it to Parliament and the regulation takes effect only when both Houses approve it.

ALSO READ | 5 issues that’ll dominate the RBI board meeting today

“Even if the board decides on 19 November to make any separate regulations regarding the reserves, it will not be effective until passed by Parliament and therefore not before the winter session," the person added.

Past regulations made by the central board include RBI Employees’ Provident Fund Regulations, RBI Employees’ Gratuity and Superannuation Fund Regulations, RBI Pension Regulations and RBI (Board for Regulation and Supervision of Payment and Settlement Systems) Regulations. The changes required in the RBI Act to accommodate the monetary policy committee (MPC) were also passed by the board.

On 9 November, Bloomberg reported that the government had asked RBI to hand over a part of its surplus reserves to be put to more productive use, citing an official in New Delhi. The report said the matter was likely to be taken up again at the RBI board meeting on Monday, adding most central banks around the world keep 13-14% of their assets as reserve, compared with RBI’s 27%.

ALSO READ | Expect the best & the worst at RBI board meeting today

However, RBI’s core reserve —contingency fund—is only around 7% of its total assets and the rest of it is largely in revaluation reserves which fluctuate with corresponding changes in currency and gold valuations. In 2017-18, the central bank’s contingency funds and revaluation reserves stood at ₹ 2.32 trillion and ₹ 6.91 trillion, respectively.

Moreover, RBI data shows that the growth in the contingency fund has not been on par with growth in revaluation reserves. While revaluation reserves have more than trebled from ₹ 1.99 trillion in 2008-09 to ₹ 6.92 trillion in 2017-18, the contingency fund has grown a meagre 50% in the same period from ₹ 1.53 trillion to ₹ 2.32 trillion. According to Niranjan Rajadhyaksha’s Mint column on 15 November, almost all the increase in RBI’s capital base in the post-crisis era is because of revaluation rather than contingency reserves and hence, RBI cannot be said to be hoarding capital.

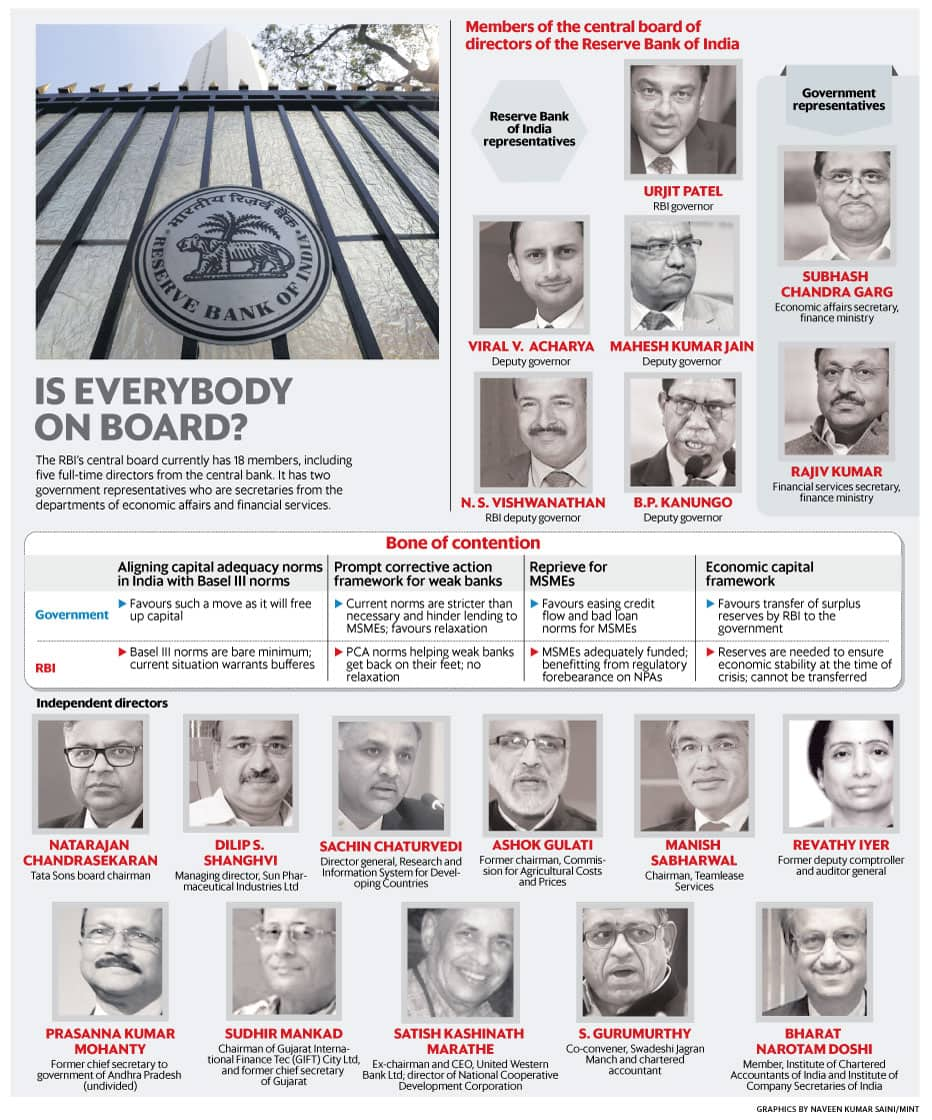

The ministry and the central bank are at loggerheads over a clutch of issues including relaxation of prompt corrective action norms, special liquidity window for non-banking financial companies, RBI’s 12 February circular on defaulters and the transfer RBI surplus to the government.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!