Explained: SBI fixed deposit account types, interest rates and maturity period

Multi-option deposit account, reinvestment account and tax savings account are some of the FD accounts of SBI

Premium

Premium

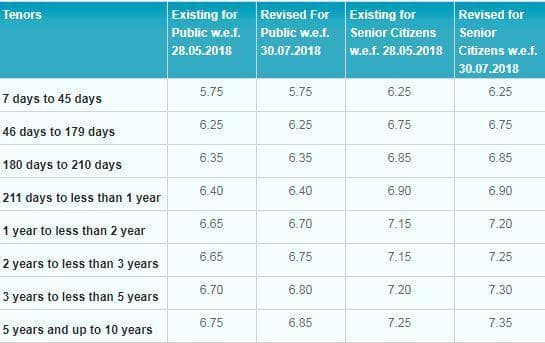

New Delhi: When it comes to investment that offers guaranteed returns, fixed deposits (FDs), also known as term deposits, are very popular among Indians. Bank FDs are meant for people who are looking for guaranteed returns, unaffected by market uncertainties. FDs require customers to deposit a lump sum for a rate of interest that is higher than that offered in savings accounts. The tenure of an FD ranges from seven days to 10 years. State Bank of India (SBI), the largest lender in the country, last revised its FD interest rates in July 2018. The higher rates are applicable on SBI fixed deposits of more than one year. SBI is offering an interest rate of 6.70% on FDs with maturity between one year and less than two years. If you keep your money with SBI for a period for 3 to 5 years you get an interest rate of 6.80%. As your term increases, so does the interest rate.

Multi-option deposit account, reinvestment account and tax savings account are some of the FD accounts of SBI.

A look at the type of SBI fixed deposit accounts:

SBI Multi Option Deposit Scheme (MODS)

SBI Multi Option Deposit Scheme (MODS) are term deposits linked to savings accounts or individual current accounts. Unlike normal term deposits, which are fully liquidated anytime you need funds, you can withdraw from a MODS account in multiples of ₹ 1,000 according to your need. The balance amount in your MODS account will continue to earn the term deposit rates applicable at the time of the initial deposit. A MODS account can be created through OnlineSBI or by visiting the nearest branch. The minimum fixed deposit amount for the multi-option deposit creation is ₹ 1,000. Any deposit above this amount is required to be in multiples of ₹ 1,000. There is no upper limit on the amount that can be deposited. The minimum tenure for this deposit is one year while the maximum is five years.

Also Read: SBI makes it easier for account holders to submit Form 15G, Form 15H

SBI Reinvestment Plan

This works like a fixed deposit. The difference between an SBI fixed deposit and reinvestment plan is that instead of interest being paid out at a regular frequency during the period of deposit, interest is paid out only at the time of maturity. Regular interest is added to the principal and compound interest is calculated and paid thereon. The minimum instalment that one is required to deposit in SBI Reinvestment Plan is ₹ 1,000. There is no maximum limit on the investment. Interest rates for SBI Reinvestment Plan are the same as on fixed deposits.

Also Read: Explained: How to open SBI zero balance savings account

SBI Tax Savings Scheme, 2006

SBI Tax Savings Scheme, 2006, offers tax benefits of up to ₹ 1.5 lakh under Section 80C of the Income Tax Act. A nomination facility is also available with the scheme. One can deposit a minimum of ₹ 1,000 or multiples thereof in SBI Tax Savings Scheme, 2006, whereas the maximum deposit should not exceed ₹ 1,50,000 in a year. The minimum tenure for this scheme is five years, which can go up to a maximum of 10 years.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!