Have expectations of a 25 bps rate cut buoyed rate-sensitive stocks?

The consensus on the Street seems to be that unless there is a surprise rate cut of over 25 bps or more dovish guidance, rate sensitive sectors may not outperform

Premium

Premium

Everybody expects the Reserve Bank of India (RBI) to cut its policy rate by 25 basis points (bps) on Tuesday. The reasons are that recent inflation data was lower than expected; Consumer Price Index-based inflation is expected to be below RBI’s projections; and the stage was cleared for a rate cut after the US Federal Reserve decided to maintain status quo on interest rates during the last policy meeting. That should have resulted in the rate-sensitive sectors outperforming, as they would be buoyed by hopes of a rate cut. One basis point is one-hundredth of a percentage point.

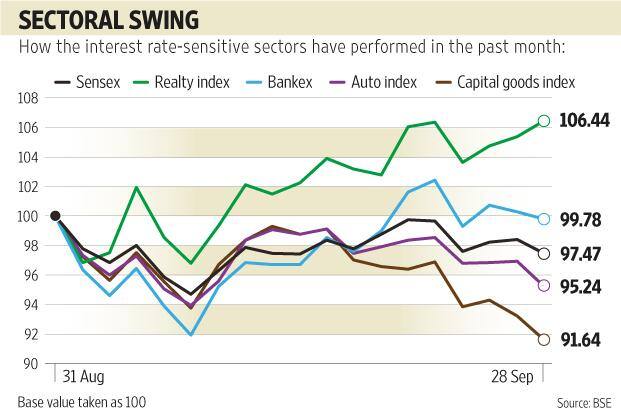

However, the reality is different. The S&P BSE Capital Goods index has fallen 8.4% and the BSE Auto index is down 4.8% since the beginning of this month, compared with the benchmark Sensex, which has fallen 2.5%. These rate-sensitive sectors do not seem to have discounted a rate cut. On the other hand, the BSE Bankex is down 0.2% and the BSE Realty index has gained 6.4%. What gives?

The fact is that each of these sectors is weighed down by problems. For instance, it’s widely recognized now that investment demand is not going to come back in a hurry, particularly since firms have plenty of unutilized capacity. Hence the failure of the capital goods indices to get excited about a rate cut.

Similarly, weak commodity prices globally are expected to weigh on the banking sector’s asset quality, especially banks that are exposed heavily to metals, although a rate cut may boost demand for credit.

For the real estate sector, property prices are not going up, there is a huge inventory overhang, balance sheets are weak and demand from the residential segment still remains tepid in big cities. For the auto sector, concerns over demand from China are affecting auto majors like Tata Motors Ltd. Rural demand is expected to remain weak because of lower-than-expected rainfall this monsoon.

For the overall markets, even if there is a 25 bps rate cut, if the underlying demand environment remains sluggish, there won’t be much impact on the rate-sensitive sectors. The global economic situation is volatile with China slowing down and weak domestic demand is affecting the interest rate sensitive sectors, said Ambareesh Baliga, a market analyst.

“A quarter percentage point interest rate cut will not be enough for the markets to react. There needs be more clarity on the future guidance and the tone of the policy," said Gautam Chhaochharia, head of research at UBS Securities India Pvt. Ltd.

The consensus of opinion on the Street seems to be that unless there is a surprise rate cut of over 25 bps or more dovish guidance, interest rate sensitive sectors may not outperform.

The writer does not own shares in the above-mentioned companies.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!