Analysts look at IT, pharma stocks as Sensex, Nifty scale record peaks

With valuations looking expensive in consumption-themed and financial stocks, analysts and fund managers are turning to information technology and pharma stocks

Premium

Premium

Mumbai: With Indian benchmarks Sensex and Nifty hovering around record highs and valuations looking expensive, especially in consumption-themed and financial stocks, some analysts and fund managers are turning to information technology and pharma shares.

Over the last month, the BSE IT Index gained 2.36% and the BSE Healthcare Index 2.86%, while the benchmark index Sensex lost 0.04%.

“I think investors should churn some of their portfolio in favour of IT and pharma as valuations start looking stretched in some other sectors," said Gautam Chhaochharia, head of research at UBS Securities India Pvt. Ltd.

At present, the Sensex trades at 18.32 times its expected earnings for the year ahead, compared to its five-year average of 15.32 times. It rose to a record high of 32,699.86 points on Monday, and has trimmed 0.95% since then.

The BSE IT index is trading at 15.18 times its estimated earnings for the year ahead, below its 5-year average of 15.96 times. BSE Healthcare index, on the other hand, is trading at 23.03 times one-year ahead earnings, a tad above its 5-year average of 21.63 times.

“In IT we are tactically overweight, because expectations are very low from the pack and misses have been fewer. If the spending of US banks picks up, they will tend to gain," said Chhaocharia. “We are selectively overweight pharma. The pain point from US generics is not completely over," he added.

Along with the regulatory struggles, Indian pharmaceutical companies are also facing a tougher business environment in the US as increased competition and consolidation in the distribution channel has enhanced pricing pressure for generic drugs. For most leading pharmaceutical companies, the US market accounts for at least half of their revenues.

For software exporters, visa woes and protectionism policies have mainly hurt sentiment. Apart from this, new technological developments such as cloud computing, automation, artificial intelligence and the likes are also weighing on these companies.

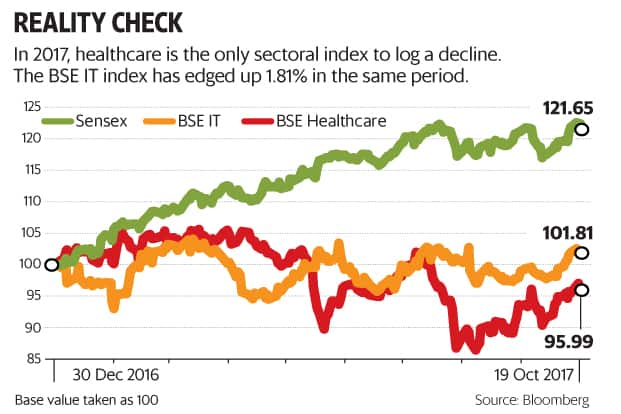

Thus, the healthcare index is the only sectoral index to log a decline this year. So far in 2017, it has shed 4.01%. BSE IT index is edged up a mere 1.81% meanwhile, in the same period

But that may change.

“I think the worst is behind IT. Growth may not pick up in a hurry, but will come by. High cash on their books also makes them look relatively more attractive and acts as a cushion for further downside," said Amar Ambani, partner and head of research at IIFL Wealth Management.

Fund managers have also been looking at this space for a while.

“We are overweight pharma for last nine months and since May we have seen rewards coming through," said S Naren, executive director and chief investment officer of ICICI Prudential Asset Management Co, which manages ₹ 1.17 trillion of equity assets. “We have been gradually increasing our weightage to IT sector which is currently our best long-term bet," added Naren.

Others such as Suhas Harinarayanan, head-institutional equity research at JM Financial Institutional Securities Ltd, believe that investors should be choosy when looking at these sectors and buy select stocks.

“We are recommending buying into select stocks in the pharma names," said Harinarayanan.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!