Mark to Market | Hotel sector: demand vs supply mismatch

The economic slowdown and cost cutting across the globe have led to cutback in business travel budgets

Premium

Premium(Pradeep Gaur/ Mint)

Nothing seems to change the fortunes of premium hotel chains. Oversupply of rooms, poor demand and stretched balance sheets are threatening their very foundation.

Demand for hotel rooms is driven by a robust economy or an increase in tourism, both of which are languishing at this point.

On the one hand, the economic slowdown and cost-cutting across the globe have led to cutback in business travel budgets. On the other, foreign tourist arrivals between January and August 2012 grew by around 6.2% over the year-ago period, whereas in 2011 that number had grown 10% over the previous year. Moreover, foreign exchange earnings growth in dollar terms was only 5.6%, down to nearly one-third that clocked in the corresponding period of the previous year.

Simultaneously, most hotel chains have added capacity over the last few years. This, along with lower demand, is now showing up in lower occupancy rates in premium hotels. Analysts say that hotel occupancy rates are plummeting steadily year after year.

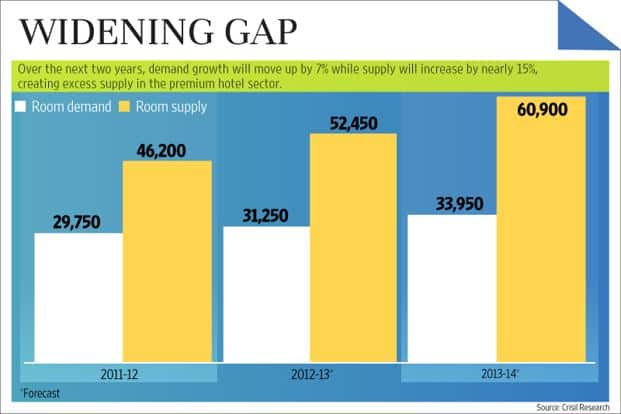

A report by Crisil Research says, “The average occupancy rates of premium segment hotels in India will touch decadal lows of 56% in 2013-14 from 64% in 2011-12—the net impact of a demand slowdown coinciding with huge supply additions. While the incremental supply over the next two years is expected to be around 14,500 rooms, incremental demand will be limited to 4,200 rooms."

Given this scenario, hotels will find it hard to raise room rates and hence the revenue per room available will also fall. The Crisil report also adds that the revenue per room available is expected to plunge to a nine-year low in the near-to-medium term. In fact, with the global slowdown hitting leisure tourism, hotels with a higher exposure to this segment will be worse off.

This is not good news. With inflation showing no signs of receding, profitability will drop. Most leading hospitality chains such as Indian Hotels Co. Ltd, EIH Ltd and Hotel Leela Venture Ltd have never revisited the operating margins clocked during the two-three years ended fiscal 2007.

The inability to offset fixed costs has pulled down operating margins. What’s worse, the hefty borrowing indulged in by most hotel chains for both capital expenditure and working capital needs has punctured net profits, too, along with a drop in growth rates of net revenue. A few like EIH raised money through a rights issue offer, which brought relief on the balance sheet front.

With nothing to cheer about, it’s not surprising that the hotel sector has been out of the investors’ universe for several years. And this is unlikely to change, unless tourism and business travel improve.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!