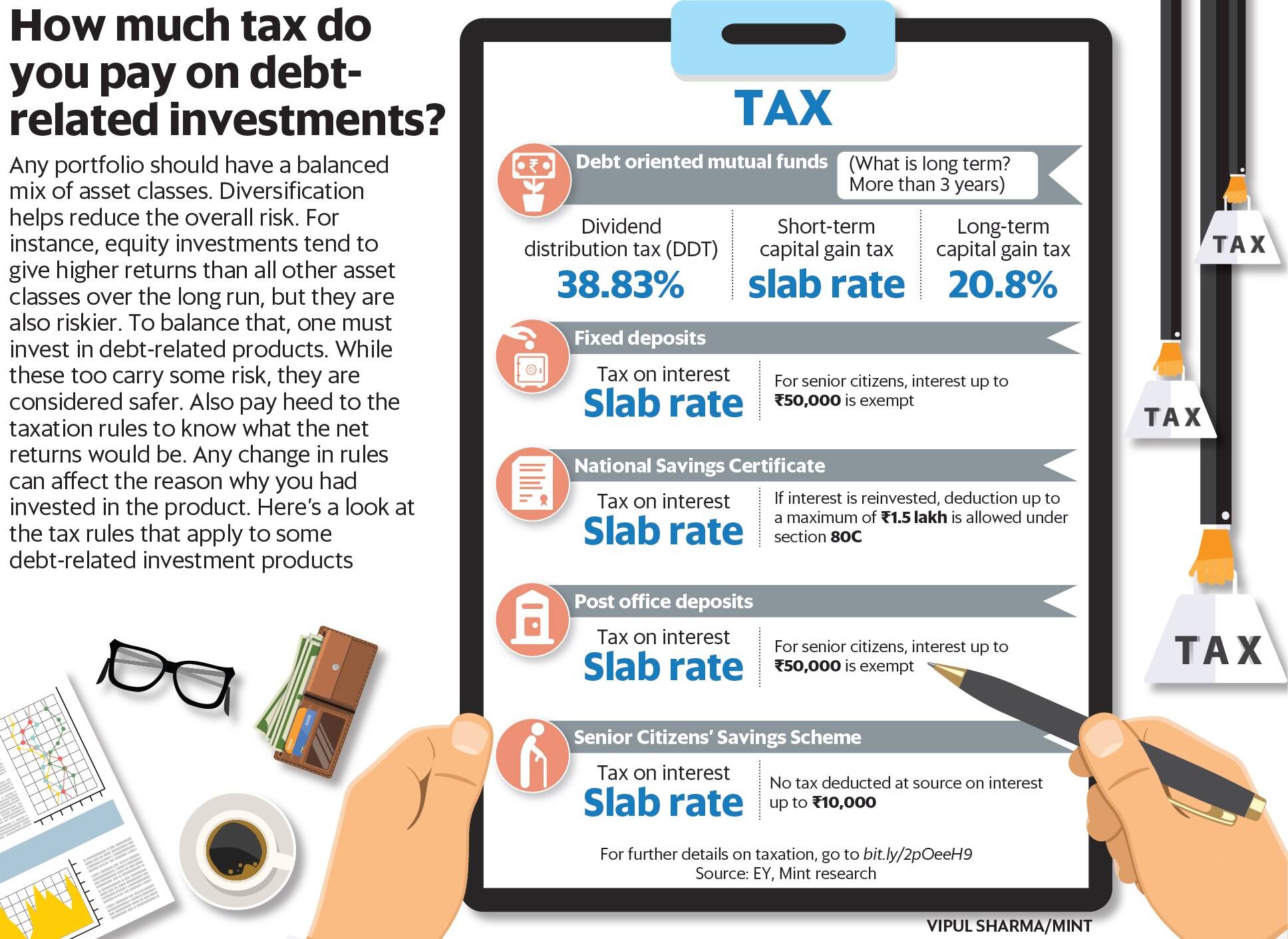

How much tax do you pay on debt-related investments?

Here's a look at the tax rules that apply to some debt-related investment products

Premium

Premium

Any portfolio should have a balanced mix of asset classes. Diversification helps reduce the overall risk. For instance, equity investments tend to give higher returns than all other asset classes over the long run, but they are also riskier.

To balance that, one must invest in debt-related products. While these too carry some risk, they are considered safer. Also pay heed to the taxation rules to know what the net returns would be. Any change in rules can affect the reason why you had invested in the product.

Here’s a look at the tax rules that apply to some debt-related investment products:

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!