What ails Tata Consultancy Services?

Something is amiss at TCS, and perhaps the most disheartening part is that the company appears to be in denial

Premium

Premium

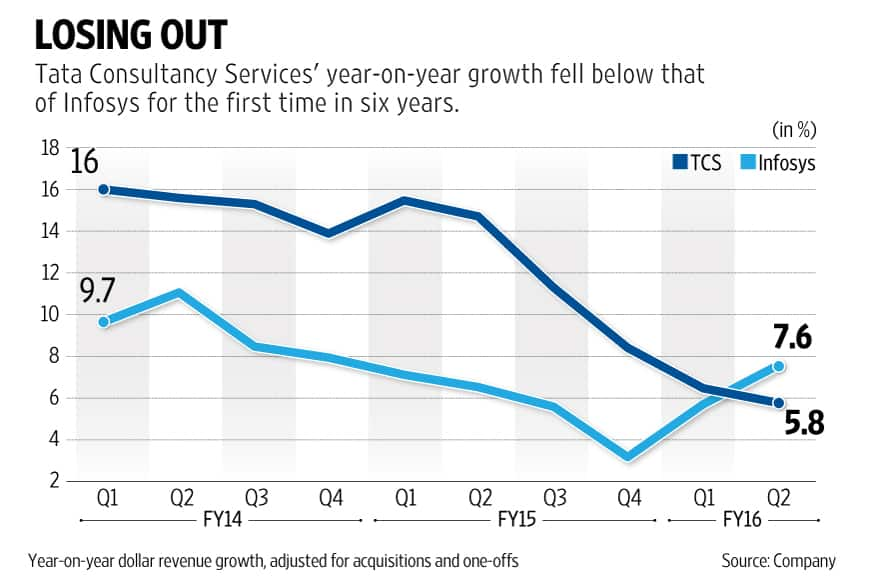

A year ago, Tata Consultancy Services Ltd (TCS) reported a 14.7% year-on-year growth in dollar revenue for the July-September quarter. This year, growth in the second quarter has fallen to 5.8%. Even Infosys Ltd, still in the middle of a turnaround, reported higher growth at 7.6% for the September quarter. Growth at Cognizant Technology Solutions Corp., another key competitor, is in healthy double-digits (15.6% in the June quarter).

Something is amiss at TCS, and perhaps the most disheartening part is that the company appears to be in denial. “We are happy with what we have delivered," chief executive officer N. Chandrasekaran told reporters while announcing results. But things have gone downhill in the past few quarters.

For the past few quarters, TCS has said that while a few of its operating segments are facing problems, the rest of its business is doing well. The ones facing problems include the business process outsourcing in the life insurance space under Diligenta and the company’s operations in Japan and Latin America. But for a company of TCS’s size, underperformance in a few small segments should be easily offset by the other segments. It doesn’t make sense to keep blaming the underperformance of the company on these segments.

The culprit, more likely, is the way the company has handled the digital opportunity. On the face of it, the company has done well— according to Chandrasekaran, revenue from digital services grew by 10% sequentially and now accounts for 13.3% of total revenue. But this also means that the rest of the business grew at a meagre 2% sequentially last quarter. Note that the September quarter is seasonally the strongest quarter.

While some amount of cannibalization of existing spending is expected with the uptake of digital offerings, it must be noted that peers such as Cognizant and Accenture Plc have managed to grow not only digital, but also total revenues at a much better pace. Analysts at JPMorgan said in a recent note to clients, “MNC (multinational company) peers such as Accenture and Cognizant are aggressively positioning their strength in digital as being helped by their consulting heritage/investments. Also, they are aggressively engaging in M&A (mergers and acquisition) and strategic investments to build out gaps in their digital portfolio. Investors are beginning to believe that consulting and active M&A/partnerships are critical to winning in digital."

TCS hasn’t yet made meaningful acquisitions in the space, nor has it linked the growth of the segment with its consulting practice. Meanwhile, while it sticks with its strategy, investors are losing patience. In the past year, while Cognizant and Accenture’s shares have risen by 49% and 37%, respectively, TCS’s shares have fallen 3.5%.

And as pointed earlier, numbers of even Infosys are beginning to look better. It’s time the TCS management woke up and smelt the coffee.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!