Sebi panel led by Uday Kotak proposes corporate governance reforms

An Uday Kotak-led Sebi panel on corporate governance reforms has suggested more powers for independent directors, greater transparency

Premium

Premium

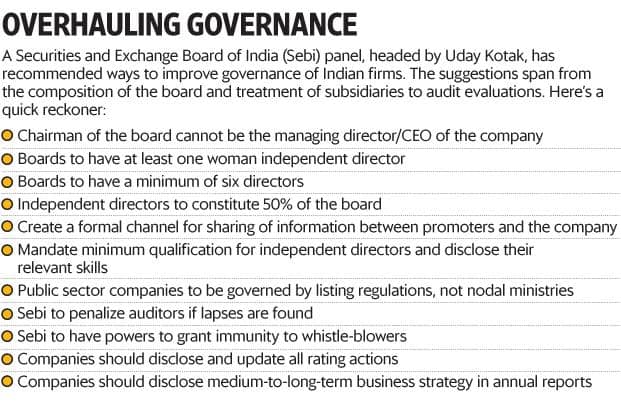

Mumbai: A Securities and Exchange board of India (Sebi)-appointed panel has proposed more powers for independent directors, limiting chairmanship to non-executive directors, and called for a greater focus on transparency and disclosures to improve corporate governance.

The panel submitted its report on Thursday. The capital markets regulator will take a call on implementation, and has invited public comments till 4 November. The recommendations span areas such as the composition of the board, the make-up of board committees, treatment of subsidiaries, information sharing with promoters and related-party transactions, audit evaluations, and conduct of annual general meetings.

For instance, the panel recommended that a listed company should have at least six directors on its board. Current Sebi regulations do not mandate a minimum number. The panel has suggested at least one independent director be a woman.

It also proposed that directors attend at least half the total board meetings held in a financial year. If they fail to do so, they would require shareholders’ nod for continuing.

Companies have asked to make public the relevant skills of directors, and the age of non-executive directors has been capped at 75 years.

In addition, the chairperson of a listed company will be a non-executive director to ensure that s/he is independent of the management.

An independent director cannot be in more than eight listed companies and a managing director can hold the post of an independent director in only three listed companies.

“The committee is wide ranging and has covered issues pertaining to independent directors, auditors, and information flow to improve governance in listed companies. In the current scenario, the information was flowing through informal channels and in a regulatory vacuum. The committee has proposed formal information channels under regulatory purview," said Cyril Shroff, managing partner of Cyril Amarchand Mangaldas, and a panel member.

Currently, boards are required to meet every quarter to discuss the financials of the company. The committee has proposed to increase the number of meetings to five a year.

The fifth meeting will discuss, among other things, whether the company has a succession plan in place, an issue that cropped up after the recent boardroom battles at the Tata group and Infosys Ltd.

Other issues to would be discussed in the proposed fifth meeting include adherence to governance standards, board evaluation and strategies for the company. Every board meeting would require the presence of an independent director.

The committee has recommended that the number of independent directors on a company board be increased from 33% to 50%.

The minimum sitting fees of independent directors has been halved from the current Rs1 lakh per meeting as stipulated by the Companies Act 2013 to Rs50,000 for the top 100 companies by market capitalization.

Detailed reasons would need to be furnished when an independent director resigns. This is to ensure that they remain independent of the company management.

“The committee has addressed the issues around independent directors and has specified a proper mechanism for sharing information between promoters and the company as not all sharing of information is illegitimate," said S. Raman, a former whole time member of Sebi.

An audit committee is being proposed with the mandate to look into utilization of funds infused by a listed entity into unlisted subsidiaries, including foreign subsidiaries in cases where the total investment is at least Rs100 crore or 10% of the asset size of the subsidiary.

The committee has also recommended that Sebi should have clear powers to act against auditors under the securities law.

For government companies, the committee has recommended that the board have final say on the appointment of independent directors and not the nodal ministry.

The panel has also proposed to tweak the definition of a “material" subsidiary to one whose net worth or income exceeds 10% (currently 20%) of the consolidated income, or net worth of the listed entity. This has been done to improve disclosure, since only the activities of material subsidiaries are disclosed to shareholders.

“Implementation of this report will require fundamental changes on multiple fronts. Companies will now have to engage more proactively, as well as closely with their independent directors," said Neeraj Gupta, partner and leader (Risk Assurance Services), PwC India.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!