Steep fall in oil prices takes a toll on remittances

Indian expatriates sent home $15.8 billion during the third quarter of fiscal 2016, the lowest in 18 quarters

Premium

Premium

Mumbai: India’s most stable source of dollar inflows, remittances from expatriates or expats, is showing signs of slowing down, reflecting the flip side of the sharp fall in global crude oil prices, which otherwise is a big positive for the country.

A large part of these remittances flow from West Asian countries that are bearing the brunt of the decline in oil prices. If prices remain low for an extended period, as is widely expected, the fall in remittances could prove to be more than a one-off, say those involved in the business of private money transfers.

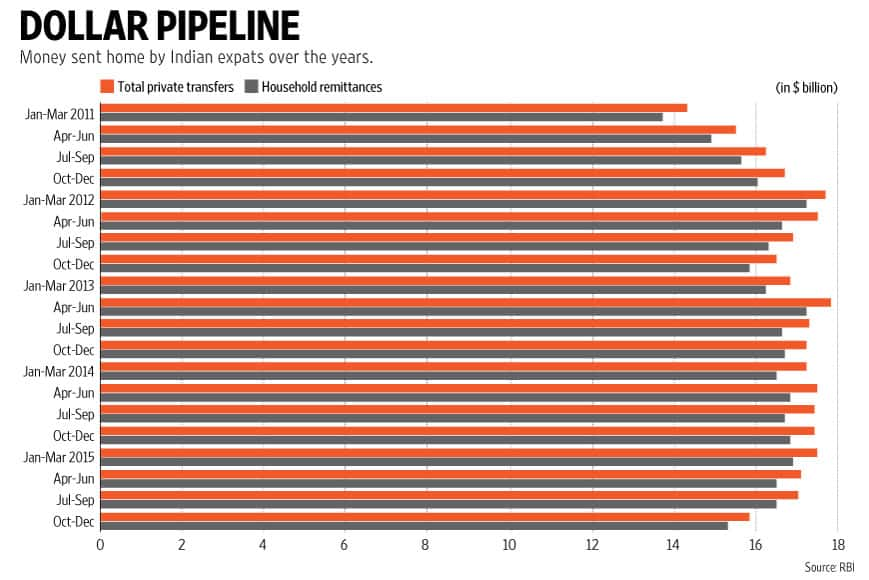

Indians remitted $15.8 billion during the third quarter of fiscal 2016, the lowest in 18 quarters, data from the Reserve Bank of India (RBI) showed. Remittances in the preceding quarter were at $16.99 billion and that in the corresponding quarter of fiscal 2015 were at $17.4 billion.

In the absence of a meaningful rebound in oil prices, these could taper off further.

“Overall, there has been a fall in remittances in the third quarter. This is because you have incomes under strain because of oil prices falling. In the coming quarters, we could face more challenges," said Ashutosh Khajuria, executive director at Federal Bank, which sees remittance flows from West Asian countries.

India was the largest remittance receiving country, with an estimated $72 billion in 2015, followed by China ($64 billion), and the Philippines ($30 billion), according to a 18 December World Bank report. Remittances to India from West Asia are the highest, forming nearly half of the total flows, added the report.

This poses a risk as oil exporters such as Saudi Arabia, UAE, Qatar and Kuwait have witnessed a sharp slowdown in their gross domestic product growth on the back of a massive 42% fall in oil prices in 2015.

Big remittance facilitators such as UAE Exchange and Western Union acknowledge that the change in economic conditions in the region is having an impact, but are not convinced the slowdown will last.

“Remittances to India is witnessing a slowdown due to the fall in oil prices and the stumbling global economy," said Sudhir K. Shetty, president of UAE Exchange, adding that there has been a “slight reduction" in the number of transactions towards the India corridor.

“As per the Migration and Remittances report published by World Bank in 2015, it was projected that the growth rate of remittances to developing countries would rise to about 4%, nearly twice the growth rate anticipated for 2015. But, looking at the present economic conditions, it seems it would take a year or so for the remittances to bounce back," said Shetty.

The report sees a 4% rise in global remittance traffic in 2016.

Kiran Shetty, managing director and regional vice-president (India & South Asia) at Western Union, is not convinced that the slowdown will be significant. He says that since a large part of the money goes towards the daily requirements of their families, such as food, the expats avoid reducing the amount of funds they send home. As such, people may choose to move to other geographies where job opportunities are better.

“When remittances decrease from one region because of the economic situation in that country/region, it will eventually increase from another country/region where the job market is better: for example, people may leave the GCC and go to the US because of the decrease in oil price. However, if the economic softening hits all global job markets, then eventually this will negatively impact the flow of remittances, not only to India, but globally," he said.

While it may be too early for a clear pattern to emerge in remittance flows, economists are taking note of the slowdown seen in the December quarter.

“Remittances are a steady source of inflows for India. While there was some expectation that the slowdown could start, it is a little worrisome that it has started early," said A. Prasanna, economist at ICICI Securities Primary Dealership.

The slowdown is a concern especially when other sources of dollar inflows such as portfolio flows are also volatile. Net portfolio flows were negative $209 million in October-December, and outflows totalled $3.7 billion for April-December 2015.

Inflows into non-resident Indian (NRI) deposits of banks, which in a way also form part of the remittance money, have slowed as well.

According to balance of payments data from RBI, NRI deposit flows were at $1.55 billion during October-December, the lowest since four quarters. Accretion to banks’ NRI deposits in January was at $992 million, a separate data release from the central bank showed.

NRI deposits are more volatile given that they are not only a function of remittances but also of interest rates and a view on the exchange rate. Typically, NRI deposit inflows rise when expectations are that the rupee would strengthen and decrease when the currency is expected to weaken. Changes in interest rates on deposits that provide an advantage over dollar rates also influence NRI deposit flows.

Noting the slowdown in remittances in a report on 21 March, Kotak Institutional Equities said that “some concerns should be expressed on private remittances falling sequentially by $1.1 billion to $15.3 billion". This is comparable to the sequential falls of $2.8 billion in the third quarter of fiscal 2009 and $1 billion in the third quarter of fiscal 2010.

“As the impact of continued low prices of oil percolates through these (oil-exporting) economies, a fall in remittances may be in the offing and the spending pattern of such remittances may become more defensive. Kerala, which sends a large number of migrants to the Gulf region, could be significantly impacted," Kotak Institutional Equities had said in a report on 19 February, which looked at the question of whether oil remittances would hold up.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!