A stronger rupee: who wins, who loses

Indian software, automobile and ancillaries, pharmaceutical companies and textiles sectors will be affected the most by stronger rupee

Premium

Premium

An appreciating Indian rupee is not good news from the point of view of corporate earnings.

On year-to-date basis, the Indian rupee has appreciated 5.3%. The rupee’s strength, fuelled by strong foreign fund inflows, a weaker US dollar and favourable domestic factors, is likely to continue in the near term, anticipate analysts.

Being a net importer, the Indian economy benefits as far as the impact on inflation is concerned. The appreciating rupee will result in lower crude oil prices for the Indian basket, keeping both wholesale and retail inflation under check in the near term.

On the flip side, India’s exports that are still struggling to see a significant revival, will suffer. This means export-oriented sectors will feel the heat, thus taking a toll on overall market earnings growth.

With nearly half of the EPS (earnings per share) of the companies that make up the Nifty linked to the global economy through exports, global subsidiaries or commodity prices, a further appreciation of the Indian rupee to a level of Rs62 per dollar could knock off 4% of earnings growth in FY18, Edelweiss Securities Ltd said in a report.

UBS Securities India Pvt. Ltd’s calculations show that every 1% appreciation in the rupee could lead to a 0.6% cut in Nifty earnings.

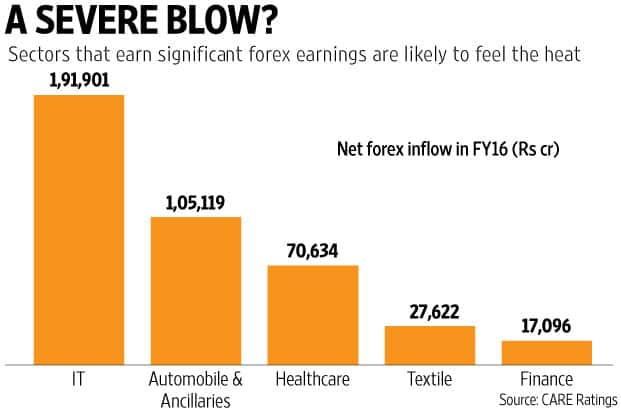

Which sectors will benefit, which will lose? Among sectors, Indian software, automobile and ancillaries, pharmaceutical companies and textiles will be affected the most since a significant portion of their revenues is dollar denominated.

In calendar year 2017 so far, the NSE Nifty IT index is down 3.9% and the NSE Nifty Pharma index is up 0.8%. Shares of Indian IT companies are already under pressure due to H1B visa issues in the US, and March quarter earnings are expected to be bleak. In such a scenario, if the strength of the rupee is sustained, then it would be an added worry, cautioned analysts.

Other losers include engineering and capital goods, metals, automobile exporters i.e. companies like Tata Motors and Bajaj Auto and the energy sector, added the Edelweiss report.

Not only listed companies, a strong rupee also hurts small and mid-sized export-oriented companies operating in labour intensive sectors as they lose competitive advantage over other emerging market peers. That could be a negative for employment.

Kotak Institutional Equities expects the Indian currency to remain strong in the next 1-2 months. As the rupee outperforms its emerging market trading partners, it does reflect on the country’s Real Effective Exchange Rate (REER). “The broad-based REER indicates that India has lost its trade competitiveness over time. This is likely to be more pronounced in labour-intensive industries such as textiles and leather, gems and jewellery," the brokerage firm’s report on rupee appreciation added.

But not all industries have lost out due to rupee appreciation.

Sectors like aviation and select consumer durables companies which import crude oil or crude oil derivatives are likely to benefit from a strong rupee.

A CARE Ratings analysis shows that in FY16, Indian oil companies (including upstream and downstream) saw a net forex outflow of Rs345,535 crore; telecom sector’s net outflow was at Rs49,917 crore and for the power sector, the outflow was to the tune of Rs26,208 crore.

“This includes companies in these sectors which have foreign currency denominated debt and would stand to benefit from lower interest outgo. In the power sector there are companies with large foreign debt and since their profitability is also low, a strong rupee helps," said Madan Sabnavis, chief economist, CARE Ratings.

Meanwhile, though a stronger rupee is negative for earnings, it is positive for the equity market.

“The Nifty’s performance, in both absolute terms as well as relative to EM, is stronger in periods of INR appreciation. Global investors’ returns in USD terms also get accentuated. Historically, 5%+ INR appreciation in any six-month period has been associated with average Nifty returns of around 20%," UBS Securities India said in a report. The Nifty has rallied 11% so far in this calendar year.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!