Is it okay for agent’s family to inherit commission stream?

While hereditary commissions protect agent's interest, the money comes out of your corpus

Premium

Premium

Mutual funds and life insurance are long term products and distributors selling these products get commissions over the course of these products. That’s because agents need to be incentivised so that they service the customers for longer. In the case of life insurance policies, agent is entitled to a commission every year and this is defined as the percentage of the annual premium paid by the policyholder whereas in mutual funds, this is referred to as the trail commission and is defined as the percentage of the fund value.

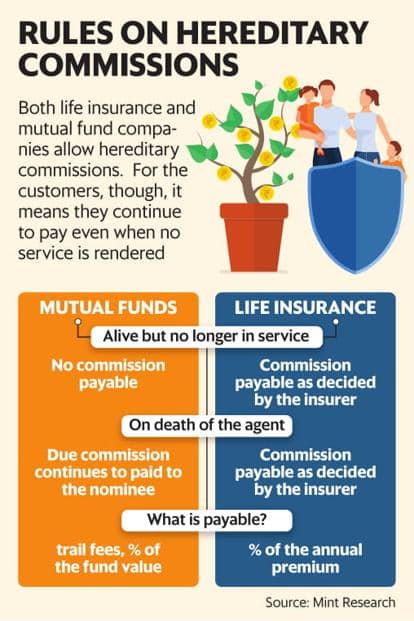

But did you know that if a mutual fund distributor dies while in business, you don’t really stop paying commissions. The commissions go to the nominee or legal heir of the deceased distributor. Even in the case of life insurance, similar provisions exist. On death of the life insurance agent, the insurance company can choose to pay future commissions or hereditary commissions accruing from the policy sold by agents to the nominee of the agents. For the life insurance business though, it’s not just on death but even when the agent has worked with the insurer for many years, insurers can continue to pay them commissions even when they leave and stop servicing the policy.

ALSO READ: Should insurers pay hereditary commission?

The law makers may have taken a benevolent stance while allowing the industry to pay hereditary commissions, but as a principle, does it make sense for the customers to pay the agents who are no longer in service? Remember, commissions come out of your investment corpus. We examine if hereditary commissions make sense from a customer standpoint. Read on.

Rules on hereditary commission in mutual fund

So long as you remain invested in a mutual fund bought through an agent, the agent is entitled to a commission. “There are many ways of designing the commission structure. Some pay upfront commissions plus trail commissions, some offer only trail commissions whereas some upfront the trail commissions. But after Sebi’s decision, the industry is set to move largely to an all trail commission model," said an executive of a mutual fund company who didn’t want to be named. Trail commission is what the agents get every year—payable monthly on a pro-rata basis—and this is calculated as a percentage of the fund value. Typically trail commissions range from 0.5% to 0.8% of the fund value. This cost is subsumed in the total expense ratio that a company is allowed to charge, but given that the commissions are pegged to the fund value, when the markets go up, the quantum of trail goes up and inverse happens when the markets point down. So, as the asset under management increases, the commission that’s payable to the distributors also increases. In other words, the more you invest, the more money your agent makes. This is fair since the agent is servicing you, she is benefitting from your upside, but logic dictates that once the agent is no longer in service, the pipeline of trail should end. But the regulators don’t take a similar view. As per a 28 March, 2013 circular by association of mutual funds in India (Amfi) which is an industry lobby, it was clarified that even in case of systematic investment plan (SIP), nominee of the deceased distributor is entitled to trail fee for the ongoing investments. “Upfront and trail commission can be paid to the nominee only for those assets which were procured by the deceased agent during the validity of his ARN prior to his demise," states the circular. Mutual fund distributors have a unique Amfi registration number (ARN), so as long as the funds are tagged to the ARN, the nominee continues to get the trail commission. You can read the full circular here.

For you this means that your investments in systematic investment plan (SIP), will continue to pay trail commissions from the past SIP and future SIP investments to the nominee of a deceased agent because the fund is tagged to the ARN. However, once the investor moves out to another fund or changes the distributor—which means the fund gets tagged to a different ARN—the trail stops going to the nominee. “On death of the distributor, if new distributor takes over the client, then neither the new distributor nor the beneficiary of the old distributor get any trail fee. But if the investor stays with the old distributor then the beneficiaries are entitled to the trail fee. Even when the investors moves to a direct plan, the trail fee stops accruing," said DP Singh, chief marketing officer (domestic business), SBI Funds Management Ltd.

Mutual fund companies that we spoke to didn’t think much of this provision because according to them, this is an insignificant pie. Also, unlike the life insurance industry where insurers are allowed to pay commissions even to “loyal" agents, mutual fund rules only allow for hereditary commissions that are inherited by the nominee on death of the distributor or agent. “This is an anomaly because if the distributor’s interests are to be protected then he should be entitled to trail even on retirement. But on retirement, unless the distributor renews his license, the license is considered expired and the agent is no longer entitled to trail," said the executive. We also reached out to Sebi official who declined to comment.

Customers lose with such archaic law

While hereditary commissions protect agent’s interest, it also raises a question from a customer standpoint. Why should the investor pay without getting any service in return? “Commissions are paid to an MF distributor to service the customer; so in the absence of service, it doesn’t make sense to continue paying a commission to the nominee of the agent," said Suresh Sadagopan, founder, Ladder7 Financial Advisories.

But as per Dhruv Mehta,chairman, foundation of independent financial advisors, paying to the nominee is only fair given that commissions are mostly trail and an agent is able to recover it only over a period of time. “When mutual funds started, the commission structures were more upfront and less trail but gradually it has moved to trail with the ban of entry load by the regulator. It was felt that distributors are remunerated over the time that customers hold their investments. The distributor spends a considerable amount of time and resources to acquire customers as well as in servicing customers post investment. For all his services he is remunerated largely by trail fee, so it’s only fair that these commissions continue to accrue for the survivors of the distributors," said Dhruv Mehta,chairman, foundation of independent financial advisors," he said.

But not everyone agrees. As per Shyam Sekhar, chief ideator and founder, iThought, hereditary commissions made sense at a time when mutual funds had not gathered steam. “The basic premise for anyone to pay commission is if a service is being rendered. MFs need the service of the agents to handhold the investors to stay invested. In the absence of the distributor, it makes little sense to pay a commission. This is also the reason why most customers end up churning their portfolio after the distributor leaves," he added. A fund manager we spoke to ascribes this phenomenon as the reason why the pie of hereditary commission is insignificant. According to him, investors don’t remain invested if they are not guided by a distributor; they either redeem or move to a new distributor.

While the regulators have taken a benevolent stance, for you the customer it means, you are paying an agent who is no longer in your service. An ideal solution to take care of dependants would be through a life insurance policy, instead of promising trail commissions to the nominees, which may not work if the investor jumps ship. Agents should be encouraged to buy term plan to provide for their family. Given the regulatory position, there is little you can do, but what you must do is to make sure you keep track of your investments.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!