Kotak Mahindra Bank delivers a hat-trick in September quarter

Not only the investment and broking businesses performed on the back of buoyant capital markets but even its lending business showed momentum

Premium

Premium

Kotak Mahindra Bank Ltd did well in the September quarter with not only its investment and broking businesses performing on the back of buoyant capital markets but even its lending business showing momentum.

The net profit of Kotak Mahindra Bank’s securities business jumped over two-thirds to ₹ 66 crore and that of the investment banking business doubled to ₹ 25 crore as corporates lined up to raise funds, riding the wave of market euphoria. More fee-based business led to a doubling of growth in other income to ₹ 466 crore in the September quarter, the highest in over four years. As long as the market sentiment remains positive, the bank’s fee-based business will continue to do well.

The management said in a conference call with analysts that it is confident of clocking 20% credit growth in the coming quarters as the economy has bottomed out. In the September quarter, consolidated advances rose 19% compared with a tepid 13% in the June quarter, buoyed by higher loans to corporates, agriculture, small businesses and personal loans. Corporate banking grew 44% with the bank focusing more on lending to mid-market companies given the recovery in the economy. Still, the bank’s commercial vehicle and construction equipment loan book continued to decline in the September quarter.

Deposits grew 29% compared with 17% in the three months ending June. Current account deposits jumped 35% on the back of wholesale and retail deposit mobilization across all segments. As a result, the bank’s stand-alone net profit growth almost tripled in the September quarter to ₹ 445 crore.

The bank continues to maintain net interest margins at 5%, the best among private lenders. Net non-performing assets as a proportion of advances increased marginally to 0.84% in the September quarter. Restructured loans considered standard assets rose to ₹ 161.5 crore, up 11% from the June quarter. Overall, consolidated net profit grew over 23% to ₹ 718 crore.

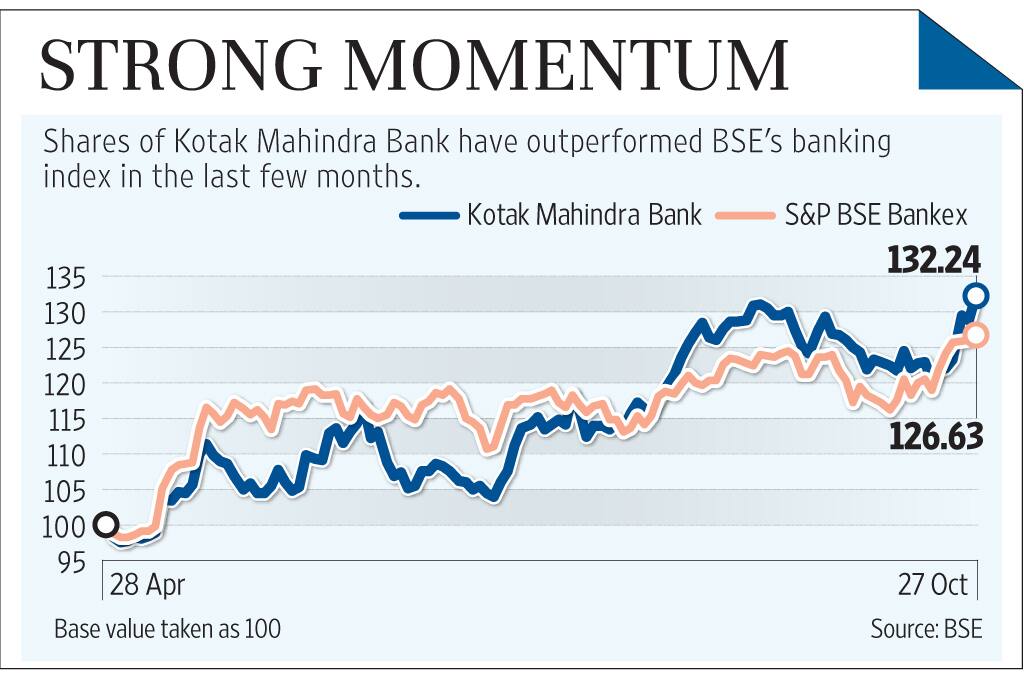

Shares of Kotak Mahindra Bank have outperformed the banking index in the last three to six months and are trading at valuations of 3.2 times future earnings. As long as the bank is able to maintain strong loan growth momentum and equity markets remain on an uptrend, it will continue to trade at a premium to most other private banks.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!