India, China lead rise of millionaires in Asia-Pacific in 2014: report

The two countries together represent 10% of the global wealthy and account for 17% of the global increase in new wealth since 2006

Premium

Premium

Mumbai: Wealthy Chinese and Indians led the rise in the population and wealth of rich individuals in Asia-Pacific in 2014, a new study said.

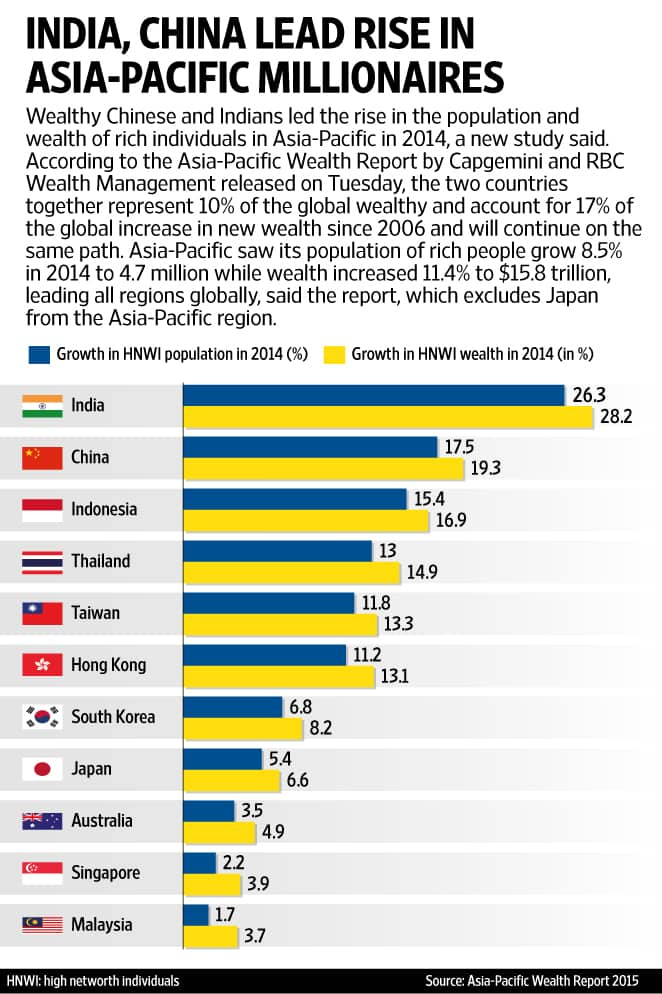

According to the Asia-Pacific Wealth Report by Capgemini and RBC Wealth Management released on Tuesday, the two countries together represent 10% of the global wealthy and account for 17% of the global increase in new wealth since 2006 and will continue on the same path.

Asia-Pacific saw its population of rich people grow 8.5% in 2014 to 4.7 million while wealth increased 11.4% to $15.8 trillion, leading all regions globally, said the report, which excludes Japan from the Asia-Pacific region.

“Asia-Pacific continues its tremendous run in wealth creation and doesn’t appear to be slowing down anytime soon," said Barend Janssens, head, RBC Wealth Management, Asia. “Despite some recent economic issues, the region’s wealth is expected to lead global growth and with this, will provide tremendous opportunities for the wealth management firms that are well positioned to meet the increasingly complex needs of HNWIs in Asia-Pacific."

According to the report, cash is now the largest component of the portfolios of these wealthy individuals at 23% in Asia-Pacific. This is closely followed by equities at 22.8% and real estate at 21.4%, which was the top-held asset last year, highlights the report. They are “more likely to use cash to invest in financial opportunities that may suddenly arise, as well as real estate investments," the report said.

Asia-Pacific is expected to expand more than any other region of the world with much of the new wealth expected to come from the emerging economies of China, India, Indonesia, and Thailand, said the report.

Asia-Pacific’s HNWI population of 4.69 million has already surpassed that of 4.68 million in North America and is also expected to overtake its $16.2 trillion HNWI wealth by end of this year, according to the recent World Wealth Report 2015.

In 2014, China saw its HNWI population grow by 17.5% to 890,000, while their wealth rose 19.3% to $4.5 trillion. India recorded the largest percentage point gains globally in its HNWI population to 198,000 in 2014. The country’s HNWI wealth rose 28.2% to $785 billion.

HNWI wealth in Mature Asia, which includes Japan, Australia, New Zealand, Singapore, Hong Kong, Taiwan, Malaysia, and South Korea, grew by 7% in 2014, and is expected to grow at a rate of 8.9% through 2017 to reach $12 trillion in wealth, said the report.

Singapore grew its HNWI population and wealth at low rates of 2.2% and 3.9%, respectively, whereas Hong Kong grew its HNWI population and wealth at 11.2% and 13.1%, respectively.

The report highlighted that Asia-Pacific’s ultra-HNWIs—those with more than $30 million in investable assets—accounted for less than 1% of the region’s millionaires in 2014, but generated over one quarter of the wealth.

“Compared to their counterparts in the rest of the world, Asia-Pacific (excluding Japan) HNWIs showcase a higher focus on and varied reasoning for holding cash and credit," said Andrew Lees, global sales officer, Capgemini’s Financial Services Global Business Unit. “Wealth managers and firms can work with the HNWIs in the region to provide them with customized opportunities in these areas, as a part of overall wealth management and goal-based planning."

Capgemini is a global consulting, technology and outsourcing services firm with global revenue of €10.57 billion in 2014. RBC Wealth Management is one of the largest wealth managers in the world and a part of Royal Bank of Canada.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!