Tata Steel drops plan to sell S-E Asian assets

Tata Steel was to sell a 70% stake to HBIS for $327 million in cashTata Steel bought NatSteel Singapore in 2004 for ₹1,313 crore, the first of its investments in Southeast Asia

Premium

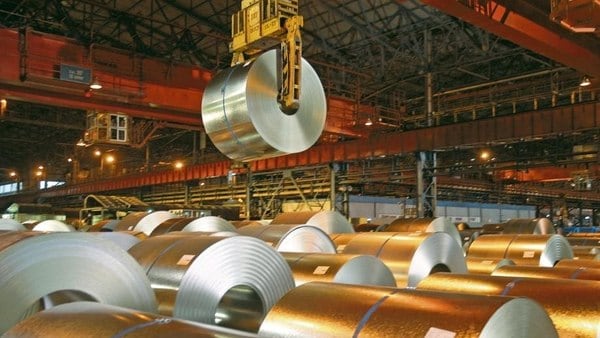

PremiumMumbai: Tata Steel Ltd has called off plans to sell a majority stake in its South-East Asia steel business to China’s state-run HBIS Group.

“We have been informed by HBIS that they have not been able to procure the requisite approvals from the Hebei government, one of the key conditions precedent for the proposed transaction. Both parties have, therefore, decided not to extend the definitive agreements," Tata Steel said in a statement. “Following the above, Tata Steel will immediately begin engagement with other investors in continuation of its strategy to find a partner for the business."

This is the second attempt by Tata Steel to offload low-margin assets abroad and pare debt. Mumbai-based Tata Steel was slated to sell a 70% stake to HBIS for $327 million in cash. Under the deal, TS Global Holdings Pte. Ltd, an indirect wholly-owned unit of Tata Steel, signed definitive agreements in January with an entity controlled by HBIS to sell its entire stake in NatSteel Holdings Pte. Ltd and Tata Steel (Thailand).

Tata Steel bought NatSteel Singapore in 2004 for ₹1,313 crore, the first of its investments in South-East Asia. It bought a Thai steel firm, Millennium Steel, two years later. Operations there however proved lacklustre from the start, with lower production, which led the units to consistently struggle to make profits.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!