India’s fintech reckoning arrives

Summary

Regulators are cracking down on financial technology firms—many backed by foreign capital—that were flourishing in the gray areasAfter a period of unbridled growth, India’s fintech industry faces a regulatory reckoning.

Things may not get as bad as they did in India’s rival China—but investors should still proceed with extreme caution until the dust settles.

On Monday, India’s central bank banned the loading of so-called prepaid payment instruments (PPIs)—essentially prepaid purchasing cards—using credit lines, jeopardizing several fintech buy-now-pay-later business models. Players such as Slice and Uni Cards—which are funded by Tiger Global, Accel, General Catalyst and Insight Partners—are likely to be affected.

Fintech players have issued hundreds of thousands of such cards with the aid of PPI licenses, and then loaded them using credit lines from banks and nonbanking financial institutions, according to brokerage Macquarie. These new-age credit cards—essentially a way to make an end run around strict credit card regulations—were targeted toward younger Indians, many of whom don’t have a long credit history.

Monday’s move indicates that the Reserve Bank of India is solidly against such a rent-a-license model where fintech startups tie up with banks and nonbanking financial institutions to sell products—a common practice in India.

In the past 18 months, the country’s financial technology sector—which has become systemically important to India—has absorbed about $14 billion of investment capital, according to data shared by Tracxn. The top global venture-capital firms have exposure—including Sequoia Capital, Y Combinator, AngelList, Accel and LetsVenture.

The RBI has in fact been advocating for tighter regulations for months: Earlier in 2022 it said it had formed a new fintech department. Monday’s circular is probably the beginning of a wider crackdown on fintech. And protecting vulnerable borrowers at a time of high inflation, tight liquidity and slowing growth is high on the RBI’s agenda. Companies in good standing with the regulator will likely emerge in better shape.

In the coming months, the Bank will likely introduce formal rules for India’s loosely regulated digital-lending ecosystem, including collection practices, data privacy, disclosures and capital-adequacy requirements. Fintech lending companies doubled disbursements in the financial year ending in March 2022 to a total of $2.3 billion, according to a report by the Fintech Association for Consumer Empowerment (FACE). Needless to say, all this will probably weigh on profitability.

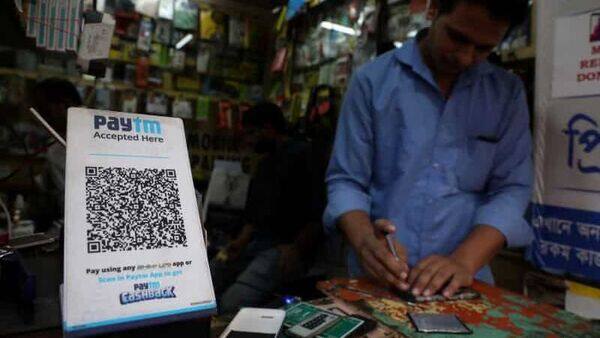

Amid India’s tech IPO boom, shares of India’s top fintech company Paytm continue to languish. This is due not only to the lack of a sustainable and profitable business model but also to the RBI’s scrutiny. Several of Paytm’s peers will now appear likely to face much more scrutiny, too.

As investors in Chinese fintech recently discovered, once your industry gets on the bad side of regulators—even if a given company isn’t an initial target—things can go downhill fast. Investors would be wise to steer clear of any Indian fintech firms which have been bending the rules until there is more clarity on how far this crackdown will run.