Yes Bank hikes MCLR rates: How does it compare with ICICI, BoB & others?

Yes Bank, a private sector lender, has raised its MCLR (Marginal Cost of Funds Based Lending Rate), which is the lowest interest rate below which financial institutions can't disburse loans to their customers.

Premium

PremiumYes Bank, a private sector lender, has raised its MCLR (Marginal Cost of Funds Based Lending Rate), which is the lowest interest rate below which financial institutions can't disburse loans to their customers. Yes Bank increased its Marginal Cost of Funds Based Lending Rate (MCLR) across tenures by 15-25 basis points after making this announcement on June 1, 2022 and as a result loan EMIs will rise for borrowers who are borrowed or are going to apply for MCLR-linked loans.

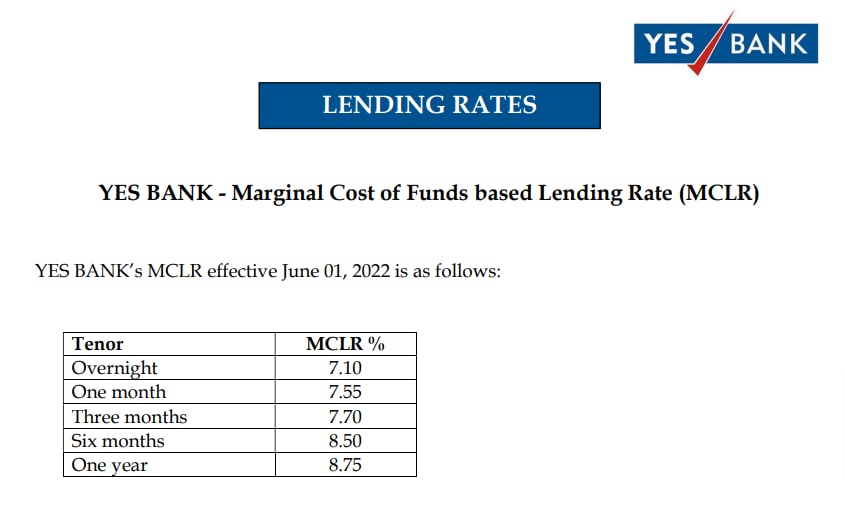

Yes Bank's overnight MCLR has been raised to 7.10 per cent as a result of the adjustment. While the bank's one-month MCLR was raised to 7.55 per cent, the three-month MCLR was raised to 7.70 per cent, the six-month MCLR was raised to 8.50 per cent, and the one-year MCLR was raised to 8.75 per cent. Yes Bank's Base Rate is 8.50 per cent as of September 1, 2021, and its BPLR is 19.75 per cent as of July 26, 2011.

Yes Bank MCLR Rates

MCLR rates have been modified for all banks as a result of the RBI repo rate rise to 4.40 per cent. The state-owned Punjab National Bank (PNB) upped its marginal cost of funds-based lending rate by 15 basis points on June 1, 2022. PNB's one-year MCLR rate has risen to 7.40 per cent from 7.25 per cent before the modification. Many financial institutions have recently raised their marginal cost of funds-based lending rate (MCLR) across tenures, including the State Bank of India, Bank of Baroda, ICICI Bank, and HDFC HFC.

All-new floating rate personal or retail loans, as well as floating-rate loans to MSMEs, shall be based on an external benchmark, according to RBI rules. With effect from June 1, 2022, HDFC increased its Retail Prime Lending Rate (RPLR) by 5 basis points on Housing loans, on which its Adjustable Rate Home Loans (ARHL) are benchmarked. ICICI Bank, on the other hand, has increased its marginal cost of lending rate (MCLR) by 30 basis points across all tenures and overnight, bringing the one-month MCLR to 7.30 per cent as of June 1, 2022.

The state-owned Bank of Baroda (BoB) announced a 10-basis-point rise in its lending rate on May 12, 2022. The bank has increased the marginal cost of funds based lending rate (MCLR) on different tenures by up to 0.1 per cent, with the 1-year MCLR being raised to 7.40 per cent which was earlier 7.35%. Borrowers who have taken out MCLR-based loans can either prepay the loan to reduce the amount of interest they pay and the amount of principal they owe, allowing them to become debt-free sooner, or they can part-pay off their loan, lowering their EMIs and the total interest they pay.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!