Does it make sense to buy RBI 7.75% bonds in low-rate regime?

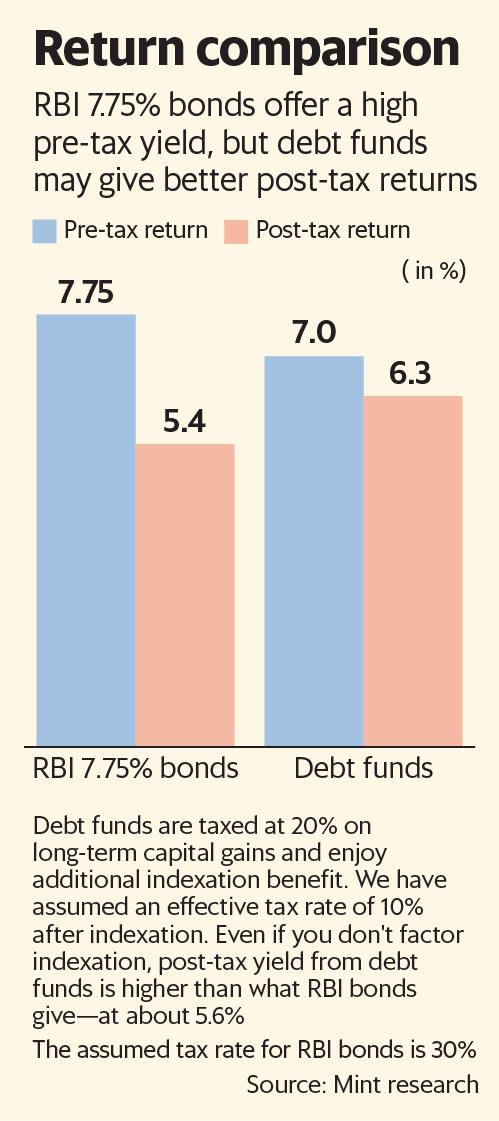

Though the interest rate offered is high, the post-tax returns are lower than what debt funds offerThe inflation rate over the next seven years can wipe out the real returns that the RBI 7.75% bonds give

Premium

PremiumOn 31 March, the government cut rates on most of its small savings schemes, including the Public Provident Fund (PPF), Senior Citizen Savings Scheme (SCSS) and post office fixed deposits(FDs). PPF and SCSS saw their interest rates move from 7.9% and 8.6% in January-March to 7.1% and 7.4%, respectively, in April-June 2020, respectively. Post office FDs saw interest rates move to the 5.5-6.7% range; banks are also offering similar rates on FDs. In this scenario, the 7.75% Government of India Savings (Taxable) Bonds, also known as RBI 7.75% bonds, look particularly attractive. As the name suggests, they offer an interest rate of 7.75% and are issued by the government of India and, hence, carry almost no credit risk. So does it make sense to invest in them?

Features of the bond

The interest rate on these bonds is calculated annually but is payable on a half-yearly basis. You can also choose the cumulative interest option in which interest is paid at the maturity of the bond. There is no upper limit for how much money you can put into these bonds. Only Indian citizens can apply for these bonds.

RBI 7.75% bonds have a tenor of seven years. However, premature encashment is allowed after six years for people between the ages of 60 and 70; after five years for those between 70 and 80; and four years for those above the age of 80. Premature encashment is not available for those below 60 years of age. However, 50% of the interest rate due and payable for the last six months of the holding period is recovered by the bonds in cases of premature encashment.

They can only be held in demat form. You can apply for these bonds through nationalized banks and through major private sector banks: ICICI Bank, HDFC Bank and Axis Bank. A spokesperson for Axis Bank confirmed that the bank distributes RBI bonds.

You can also apply for the bonds through the Stock Holding Corp. of India (SHCI), a subsidiary of IFCI Ltd (stockholding.com), which is a public sector non-banking financial company (NBFC). “The applicant needs to do the online KYC using Aadhar. He needs to upload PAN card and the scanned image of a cheque leaf., then do the e-signature and payment. Payment is acceptable by internet banking, RTGS and NEFT," said an SHCI spokesperson.

The disadvantages

The bonds do have some disadvantages. First, the interest rate payable on the bonds is fully taxable. Tax deducted at source (TDS) is cut on the interest payout.

“The RBI bonds do have a place in the portfolio, particularly for someone who wants a fixed return. The lack of an upper limit for investment in the instrument and virtually risk-free return make them particularly attractive," said Nithin Sasikumar, co-founder, Investography, a financial planning firm.

“On the flip side the bonds have a long tenor and are not liquid. Post-tax, they will be beaten by debt funds although the latter do come with volatility," he added.

Investors should note that debt funds held for longer than three years are taxed at 20% and investors are also given the benefit of indexation. On the other hand, interest on the RBI 7.75% bonds is taxable at the investor’s income tax slab rate. For an investor in the 30% slab rate, the post-tax return drops to 5.42%.

One rough way to compare the two options is to look at the yield-to-maturity minus expense ratio of the debt fund concerned which will broadly give you the pre-tax return, assuming no major interest rate changes or credit events. You can then apply your tax rate to this figure to get your post-tax return (see graph). Even if you don’t factor indexation, post-tax yield in debt funds is higher than RBI bond at about 5.6%. If this looks too complicated, ask your financial adviser to perform these calculations.

The second major issue with them is that of inflation eating into the returns. The covid-19 outbreak has dramatically lowered the inflation outlook for the near term, but this could well go above 5% on average over the next seven years, thereby wiping out the real returns from these bonds, although this risk applies to other fixed-income instruments as well. The RBI’s inflation comfort zone is 4% plus or minus 2%, placing 5% well within that comfort zone. Consumer Price Inflation (CPI) in January 2020 surged to 7.59%.

The third big issue is that of liquidity. The bonds have a term of seven years and cannot be sold before that time period in the secondary market. Even for senior citizens, the lock-in ranges from four to seven years depending on the age group.

Also, you cannot avail of loans from banks and NBFCs against these bonds.

Should you buy?

If you are a risk- averse investor, you should consider these bonds only for that portion of the portfolio that can be locked away for a period of seven years during which time the principal amount cannot be accessed.

If you are looking for guaranteed income options, these bonds may fit the bill and may help you create income ladders to provide a stream of income in the future, say, to meet a recurring expense like education fees or income in retirement. For example, if you need to meet four years of college fees from 2027, then buy the required bonds with the cumulative option in 2020, 2021, 2022 and 2023. From 2027 onwards, for the next four years, you will get the maturity amount that can be used to meet the expense. For regular income in retirement, you can buy the bond and receive half-yearly income for seven years.

But be careful when opting for these bonds to create an income ladder as you can’t be sure how long they will continue given the recent spate of rate cuts for other government schemes. According to Deepali Sen, founder, Srujan Financial Advisors, a financial planning firm, it is unclear how long the government would permit such a high-yielding instrument to continue, given rate cuts elsewhere and, hence, creating an income ladder from it at this stage may not work.

She added that the bonds may be suitable for senior citizens, but only those willing to compromise on liquidity and who may be looking at passing on their assets to the next generation.

The rapid drop in the rates of fixed-income options in India has made RBI bonds relatively attractive if you are looking for a fixed return. For senior citizens, in particular, the lock-in is lower at four to six years. They may consider some investment in these bonds along with other options such as SCSS. If you want assured income for the next seven years and don’t wish to stomach the volatility in debt funds or the risk in corporate bonds, this is a good option.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!