India on the cusp of the age of super apps

Business is down, of course, but the internet economy has received a big digital push thanks to the pandemicMost shoppers still use different apps across e-commerce, travel, food delivery and other sectors. With the increasing depth and width in the internet economy, this could change

Premium

PremiumBENGALURU : India’s first nationwide lockdown in late March did not spare internet businesses. The internet market shrank to about 15% of pre-covid levels over the next month. But starting from May, when lockdowns were eased and the initial disruptions in supply chains were largely resolved, the internet ecosystem has been seeing a slow and steady recovery driven by sectors like e-commerce, online pharmacies and digital education.

In June, the internet market rose to an annualized $45 billion, well below its pre-covid level of $75 billion annualized, but up sharply from its April number of $10 billion, according to a report by market research and advisory firm RedSeer Management Consulting Pvt. Ltd.

The numbers are the latest proof that the outbreak of the novel coronavirus has battered internet businesses. The pandemic’s impact, however, has been extremely uneven. While sectors like travel, hospitality and mobility have collapsed, it has brought about an unprecedented boom in sectors like online grocery and digital education.

In an effort to identify the internet companies that have benefited most from the lockdown, RedSeer has compiled a Covid Impact Leadership Index that it shared in a report with Mint. To arrive at a score, RedSeer used three parameters: resilience, which looks at metrics like new customer additions and time spent; innovation, which captures consumer perception of new products, services and features launched by the internet platforms during the lockdown; and empathy, which measures the consumer perception of the health focus and charitable contributions of the internet companies.

According to the index, the big winners of the lockdown were BigBasket, Flipkart’s grocery ordering app Supermart and Amazon’s grocery business. These were followed by Grofers, Netflix and PharmEasy. Other top performers in the index include Amazon Prime, Medlife, Paytm and PhonePe.

The index is entirely based on consumer surveys. RedSeer surveyed more than 7,000 internet users across 30 cities to compile the index, which covers about 100 internet companies. All these users were people who had bought products from the companies in the index. The index covers the period from late March to late May.

The RedSeer report shows that millions of people who were earlier buying only a small number of products and services on the internet were forced to move a large part of their overall spending to the digital medium from offline.

In the last three months, customer retention rates have shot up anywhere between two to three times for internet platforms. At the same time, their customer acquisition costs plunged as much as 80%, and even more in some spaces like online grocery, e-pharmacies and online education, RedSeer data shows.

Given that internet companies spent up to $3 billion on customer acquisition in 2019, the savings will provide a boost to the companies’ bottom-lines this year. For the winners, it’s a dream combination: add millions of new users and retain most of them while spending far less money to attract them.

Notwithstanding the short-term hit, these trends indicate that the pandemic has triggered some structural shifts in consumer spending habits and usage patterns that will bring huge benefits to internet companies over the coming years.

The report’s findings confirm what entrepreneurs in spaces like online grocery, e-pharmacies and digital education have been saying. Companies like BigBasket, Grofers, Practo, 1 mg, Byju’s and Unacademy are all registering a spike in usage and sales even as India braces for a sharp economic contraction this year. These companies are all in talks to raise large amounts of capital at soaring valuations amid a broader funding downturn for internet startups.

State of the internet

The recovery in the internet economy has been driven by a strong rebound in e-commerce. Compared with January levels, online retail was up by more than 10% to an annualized $33 billion in June, compared with January. In the first six months of 2020, private consumption spending dropped by as much as 33% from last year’s levels. Given the drop in offline retail, e-commerce comprised 4.5% of India’s overall retail market in June, a big jump from 3% in January.

Pent-up demand and clearance sales have driven recovery of e-commerce across sectors, RedSeer said. Still, more than 50% of the people in the survey said that they will “trade down"—buy cheaper brands—over the next six months in discretionary categories like fashion, electronics and personal care, reflecting worries about the poor economy and income losses. This means that the private label products of online retailers like Flipkart and Amazon India may become a key area of focus.

Within e-commerce, nearly all categories, except fashion, grew in size in June compared with January. The sharpest expansion came in online groceries, large appliances and other electronic products. Products like laptops and televisions are seeing high demand as people across large and small cities are forced to continue working from home.

The growth in online groceries has sustained despite the partial reopening in cities. RedSeer said that e-groceries has seen the addition of two major sets of customers: middle-age people in metros and affluent users in tier II cities and below. Previously, online grocery services were mostly used by millennials in big cities.

Sales of fashion products, however, are still down from pre-covid levels, as people working from home have cut back spending on clothes and footwear. Still, even within fashion, online firms have fared much better than offline chains like Shoppers Stop and Future Group that are struggling to attract customers after reopening their stores in some cities.

Three other sectors have benefitted from the pandemic: online healthcare, digital education and entertainment content. Scores of patients and doctors both have been forced to rely on digital health platforms to treat fevers, coughs, mental illnesses and other ailments as many clinics remain shut. More people are ordering medicine online. Internet penetration in digital health doubled to 2% of the overall market in June from January, RedSeer data shows.

With schools and colleges shut, and the fear of transmission leading to a cancellation of offline tuition classes, digital education has seen a surge in demand. Digital education doubled in size in June from pre-covid levels. By 2022, the sector will grow to $3.5 billion from about $750 million last year, according to RedSeer estimates. Audio and video entertainment apps like Netflix, Amazon’s Prime Video and Jio’s Saavn have seen usage jump to all-time highs. By adding dozens of new films, TV shows and other content and offering flexible pricing plans, their subscription numbers have increased too.

Travel, expectedly, has collapsed. The size of the online travel market shrank to $2.2 billion in June from nearly $22 billion in January, according to RedSeer’s data. All affected companies, including Oyo, MakeMyTrip, Yatra, Treebo and others have cut thousands of jobs since March.

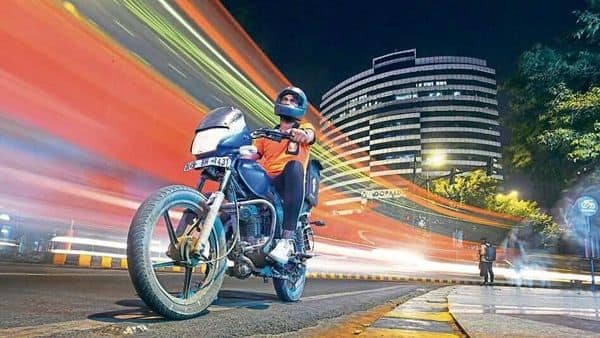

Another sector badly hurt by the pandemic is mobility. In May, bookings at mobility firms like Ola, Uber, Bounce, Vogo and others were less than 10% of their pre-covid figures. These firms, too, have cut hundreds of jobs and other expenses to conserve cash in order to tide over the crisis.

Demand for food delivery has also slumped, hurting both Swiggy and Zomato. In June, the food delivery sector was at just 40% of its regular size, according to RedSeer. People have cut back on ordering food in favour of cooking meals at home. Restaurant and bar visits were completely halted till the end of May. Though some state governments began to allow restaurants to open last month, only 20-30% of all dine-in restaurants in India are operating, as per RedSeer estimates. Even these are now struggling to attract customers.

However, both Swiggy and Zomato were among the top 15 in RedSeer’s index, mostly because people surveyed said they appreciated the efforts of the two companies to protect the health of their workers and customers by introducing measures like contactless delivery and temperature checks of delivery executives. Swiggy’s expansion of its grocery service was also well-received by customers.

In terms of recovery of the struggling sectors, the survey showed that people expect the mobility and food delivery spaces to regain 90% of their old business by December. Travel, however, could take far longer to recover.

Cross-platform usage

In 2019, of the 583 million internet users in India, only 232 million people paid for any service or product online at least once (the rest used the internet primarily for messaging and browsing), according to RedSeer. And even among the 232 million, only 135 million bought products from e-commerce platforms, indicating the relative shallowness of the internet economy.

According to RedSeer, it is largely the same set of users that has driven the recovery in the internet economy since May. What’s different is that users who were earlier only buying something once or twice a year in the past have now been forced to buy both more frequently and a wider range of goods and services.

“There hasn’t been much expansion in the overall number of transacting users, but there is a steep growth in the number of serious or holistic users who are shopping on multiple platforms," said Mrigank Gutgutia, an associate director, RedSeer.

RedSeer said that this change could finally sustain so-called super apps in India.

Super apps are dominant in China’s internet space where platforms owned by Tencent, Alibaba and Meituan-Dianping offer a wide range of products and services like e-commerce, travel bookings, food delivery and cab bookings all within the same app. In India, so far, this concept hasn’t worked. Most online shoppers still use different apps across e-commerce, travel, food delivery and other sectors. With the increasing depth and width in the internet economy, this could change, potentially providing a boost to Paytm, PhonePe and Amazon Pay, which are attempting to become super apps.

“From the customer surveys, what has emerged is that there are now a very large number of online users who are using multiple platforms. We believe that this is the right time for a super app to emerge," Gutgutia said.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it's all here, just a click away! Login Now!